Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

Managing over $25 billion in client assets since 2003, Advanta IRA stands out as a collection of self-directed IRA administrators working together under one brand.

We’ve spent considerable time researching their services and discovered they’re handling some impressive numbers – with over 160 Google reviews averaging 4.6 stars.

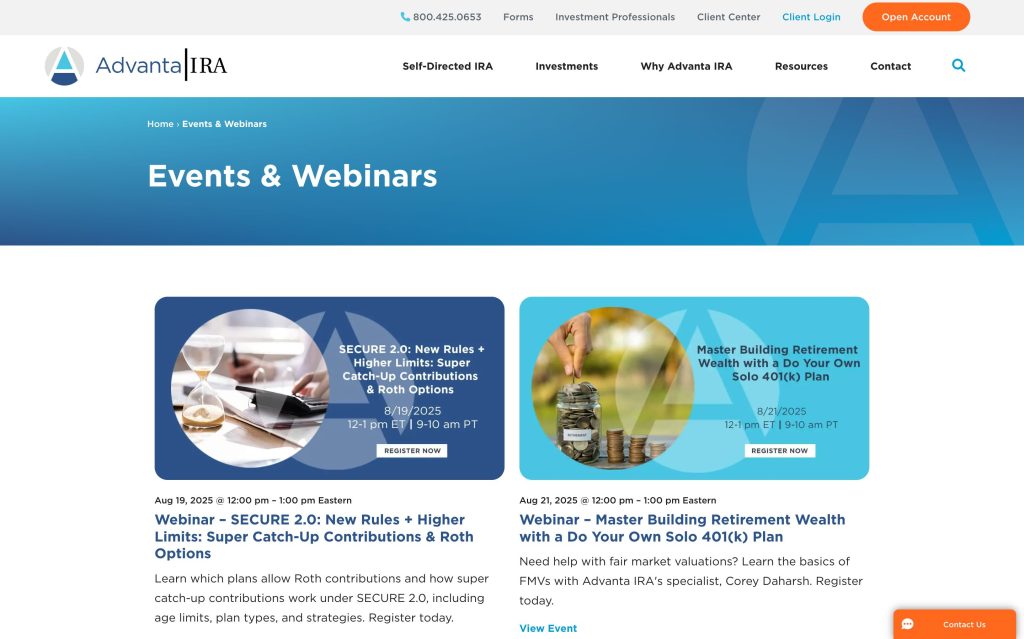

What caught our attention during our research wasn’t just their size. It’s their approach to education. While most companies charge hundreds for seminars, Advanta offers free weekly sessions.

They’ve built their reputation on helping you navigate IRS compliance while you focus on finding the right investments for your retirement portfolio.

We’ll break down everything we found about their fees, services and customer experiences. Keep reading!

Table of Contents

About Advanta IRA

We discovered that Advanta IRA operates differently from traditional IRA custodians by functioning as a collection of elite self-directed IRA administrators working under one umbrella.

We discovered that Advanta IRA operates differently from traditional IRA custodians by functioning as a collection of elite self-directed IRA administrators working under one umbrella.

This unique structure allows them to maintain specialized expertise while serving clients nationwide with over $25 billion in assets under administration.

History and Experience

Advanta IRA launched operations in 2003 when founders Jack Callahan and Doug Davenport recognized a gap in the self-directed IRA market.

The company initially provided tax, legal, financial and accounting services before focusing exclusively on self-directed IRA administration.

Over twenty years later, they manage more than $25 billion in client assets with a team of 35 professionals operating from their Largo, Florida headquarters.

Their growth from a multi-service firm to a specialized IRA administrator reflects their commitment to mastering one area rather than spreading resources thin.

This focused approach has earned them a 3.5 rating from Focus on the User and helped them build a client base that spans all fifty states.

Management Team

The company employs certified financial planners and lawyers who bring diverse expertise to client accounts.

Each client receives a dedicated account manager who handles their specific needs throughout the investment process.

These managers undergo continuous training to stay current with IRS regulations and alternative investment strategies.

What sets their team apart is their educational focus – staff members regularly lead free weekly seminars that competitors typically charge hundreds of dollars to attend.

The management structure ensures clients work with professionals who understand both the administrative requirements and the investment world of self-directed IRAs.

Industry Certifications and Affiliations

Advanta IRA maintains strict compliance with Internal Revenue Service regulations and files all required reports on behalf of clients.

The company operates as a registered IRA administrator authorized to handle alternative investments including real estate, private equity, mortgage loans and tax liens.

Their certification status allows them to provide checkbook control features that give you direct access to your retirement funds for approved investments.

The company’s compliance team ensures all transactions meet IRS guidelines while their educational programs help you understand contribution limits and prohibited transaction rules that protect your account’s tax-advantaged status.

Account Types and Investment Options

When we researched Advanta IRA’s offerings, we discovered they provide more flexibility than typical retirement custodians.

Their platform supports both traditional retirement structures and alternative investments that most banks won’t touch.

Available Account Types

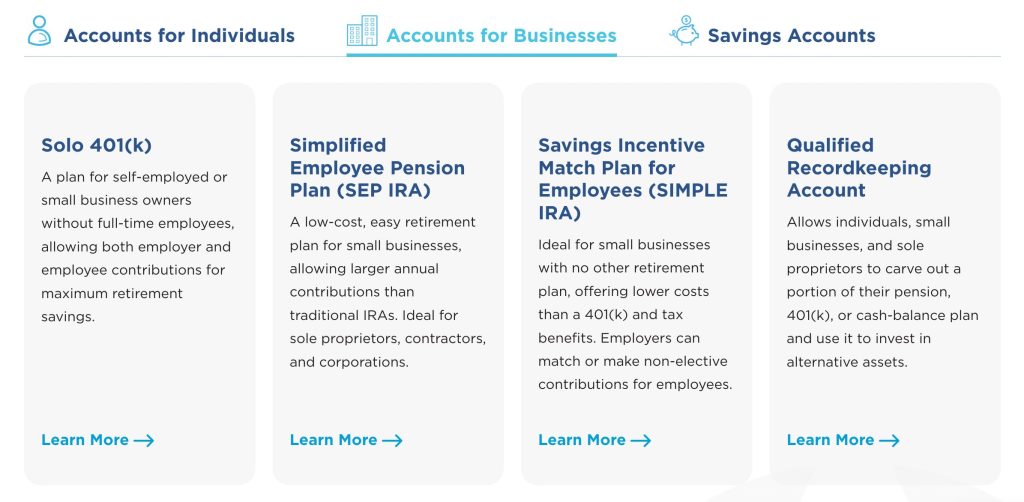

Advanta IRA maintains five distinct retirement account types that cover most retirement planning needs:

- Traditional IRA: Pre-tax contributions with tax-deferred growth until withdrawal.

- Roth IRA: After-tax contributions allowing tax-free withdrawals in retirement.

- SEP IRA (including SERSEP): Simplified employee pension plans for self-employed individuals and small business owners.

- SIMPLE IRA: Savings incentive match plans for employees of small businesses.

- Individual 401(k): Solo 401(k) plans for business owners without full-time employees.

Each account type follows specific IRS contribution rules and tax structures. The variety means you can select the account that matches your employment status and tax strategy.

We found that having all these options under one custodian simplifies account management if you need multiple retirement accounts for different purposes.

Alternative Investment Options

The real distinction of Advanta IRA lies in their alternative investment capabilities. While traditional custodians limit you to stocks and mutual funds, Advanta opens doors to:

- Real Estate: Direct property ownership or real estate investment trusts.

- Private Equity: Stakes in private companies and startups.

- Precious Metals: Physical gold, silver, platinum, and palladium.

- Private Notes: Secured and unsecured lending opportunities.

- LLCs: Business ownership interests.

- Cryptocurrency: Bitcoin and other digital assets.

This breadth transforms retirement planning from passive fund selection to active portfolio construction. You gain control over specific assets rather than generic market exposure.

We noticed their $25 billion in managed assets reflects strong investor confidence in these alternative strategies.

Prohibited Transactions

IRS rules create strict boundaries around self-directed IRA investments. Violating these rules disqualifies your entire account and triggers immediate taxation:

- No Self-Dealing: You cannot sell property to your IRA or buy from it.

- Disqualified Persons: Parents, children, spouses, and business partners cannot transact with your IRA.

- No Personal Benefit: Your IRA cannot loan you money or pay your expenses.

- Arms-Length Only: All transactions must occur at fair market value.

Breaking these rules costs more than penalties. Your entire IRA balance becomes taxable income that year. We found that understanding these restrictions before investing prevents costly mistakes.

Advanta IRA helps monitor transactions for compliance, but ultimate responsibility rests with you as the account holder.

Features and Services

We discovered that Advanta IRA structures their services differently than traditional IRA custodians. Their approach centers on providing administrative support while giving you complete control over your investment decisions.

Account Management Tools

Advanta IRA provides client account access through their online platform. You receive checkbook control features that allow direct access to your retirement funds.

The system handles IRS compliance reporting automatically and issues regular account statements. You can submit documents through multiple channels including mail, fax, and scanned PDFs.

The platform tracks contribution limits and monitors permissible transactions according to IRS guidelines. While the company maintains $2.3 billion in assets under management, specific details about digital tools and platform features remain limited in public information.

Educational Resources

The company runs free weekly seminars featuring guest speakers who explain self-directed investing strategies. You get access to live webinars that break down complex IRA regulations into understandable concepts.

Advanta IRA provides tailored explanations for specific investment scenarios you might encounter. Their education program covers IRS compliance requirements and alternative investment options.

The team explains contribution limits and prohibited transaction rules during these sessions. You learn how different retirement account types work for various investment strategies through their ongoing educational initiatives.

Customer Support Quality

Each client receives support from dedicated account managers who handle their specific needs. The company maintains an A+ Better Business Bureau rating based on their service record.

Response times vary with some clients reporting delays in transaction processing and communication. You work with certified financial planners and lawyers who provide personalized guidance without offering direct investment advice.

The support team processes most document submissions quickly through their multiple acceptance channels. Customer feedback shows appreciation for the knowledgeable staff while noting room for improvement in response speed during peak periods.

Fee Structure and Pricing

Understanding the exact costs of a self-directed IRA can save you thousands in unnecessary fees. We discovered that this custodian takes a refreshingly transparent approach to pricing that sets them apart from competitors who bury fees in fine print.

Setup and Annual Fees

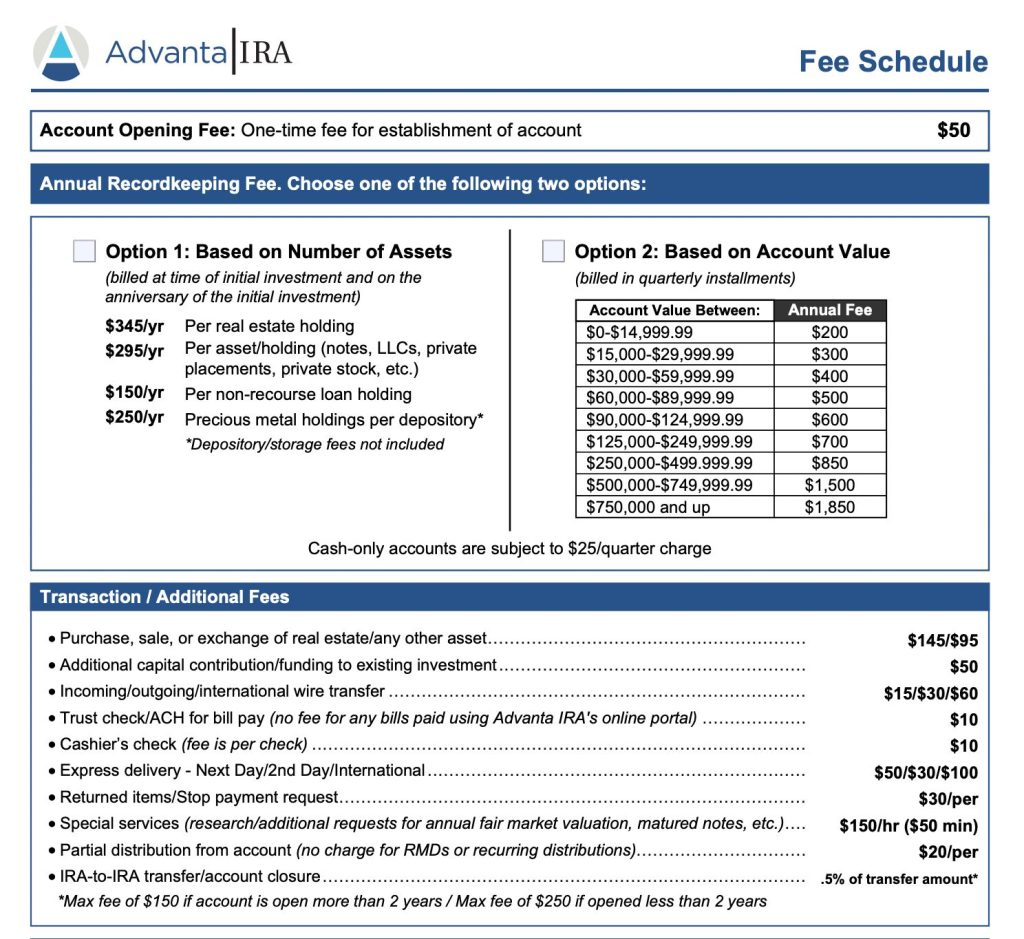

The account setup process starts with a one-time $50 fee that gets your self-directed IRA operational. For cash-only accounts you’ll pay $25 quarterly which totals $100 annually.

If you hold alternative assets like real estate or precious metals the annual fee caps at $300. This covers all administrative duties including IRS reporting and record keeping throughout the year.

We found this pricing structure particularly attractive for precious metals investors. Most custodians charge significantly higher fees for storing physical gold and silver.

The $300 annual maximum protects you from escalating costs as your portfolio grows. You won’t face percentage-based fees that punish successful investing.

Transaction Costs

Real estate transactions cost $145 for purchases and $95 for sales. Adding capital to your account triggers a $50 fee per contribution.

Wire transfers run $15 for incoming funds and $30 for domestic outgoing transfers. International wires cost $60.

| Transaction Type | Cost |

|---|---|

| Real Estate Purchase | $145 |

| Real Estate Sale | $95 |

| Capital Contributions | $50 |

| Domestic Wire (Outgoing) | $30 |

| Cashier’s Checks | $10 |

| Partial Distributions | $20 |

The online portal waives the $10 fee for trust checks and ACH bill payments. Account closure or transfers cost 0.005% of your account value with a $250 maximum.

Hidden Charges

After examining the full fee schedule we found zero hidden charges or commissions. Every fee relates directly to specific administrative services or transactions you request. The company explicitly states all costs upfront without surprise additions later.

This transparency extends to their precious metals program where many competitors hide markup fees. You pay only the stated administrative costs plus the actual metal prices.

No backend loads or mystery charges appear on statements. The 0.005% account closure fee caps at $250 which protects you from excessive exit costs if you switch custodians.

Performance and User Experience

We discovered that Advanta IRA’s performance metrics paint an interesting picture when you dig into the actual user experiences.

Their track record with alternative asset transactions reveals both strengths and areas where patience becomes necessary.

Platform Usability

The platform design prioritizes function over flashy features. You get checkbook control capabilities that let you move quickly on investment opportunities without waiting for custodial approval on every transaction.

The online portal handles basic account management tasks effectively though some sections feel dated compared to modern fintech interfaces.

Key platform features you’ll work with:

- Direct access to account statements and tax documents.

- Transaction history tracking for all alternative investments.

- Wire transfer initiation without phone calls.

- Document upload system accepting PDFs and faxes.

Real estate investors particularly appreciate the streamlined process for property transactions. The system guides you through required documentation step by step which reduces confusion around IRS compliance requirements.

Processing Times

Transaction speeds vary significantly based on investment type. Our research uncovered these typical timeframes:

| Transaction Type | Average Processing Time |

|---|---|

| Real Estate Purchases | 2-3 weeks |

| LLC Setup with Checkbook Control | 5-7 business days |

| Wire Transfers | 24-48 hours |

| Document Review | 3-5 business days |

| Account Funding | 2-3 business days |

Users switching from competitors report faster processing overall. One client noted their real estate flip funding completed weeks faster than their previous custodian managed.

The team coordinates directly with title companies which eliminates common bottlenecks during property closings.

Phone support responds quickly during business hours though email responses sometimes take 24-48 hours for complex questions.

Account Opening Process

Starting your account involves several distinct steps that take approximately 7-10 business days total:

Step 1: Application Submission (15 minutes)

- Complete online forms with personal information.

- Select account type (Traditional, Roth, SEP, SIMPLE, or Individual 401k).

- Submit initial documentation.

Step 2: Verification Process (2-3 days)

- Identity verification through standard KYC procedures.

- Review of submitted documents by compliance team.

- Follow-up calls if additional information needed.

Step 3: Funding Your Account (3-5 days)

- Transfer funds from existing retirement accounts.

- Direct contributions via check or wire.

- Confirmation of funds received.

Step 4: Investment Setup

- Schedule consultation with dedicated account manager.

- Discuss investment strategy and compliance requirements.

- Receive guidance on specific alternative asset procedures.

The dedicated account manager assignment happens immediately after approval. They contact you within 24 hours to explain next steps and answer questions about permissible investments. This personal touch helps avoid costly compliance mistakes early on.

Customer Reviews and Reputation

Advanta IRA maintains a strong reputation in the self-directed IRA industry with an A+ Better Business Bureau rating and over 160 Google reviews averaging 4.6 stars.

Our research reveals both strengths and challenges that shape customer experiences with this administrator.

Client Testimonials

Clients consistently praise Advanta IRA for personalized service that goes beyond standard IRA administration.

One attorney working with multiple IRA administrators stated that Advanta IRA stands out as “the most pleasant IRA administrator” in their practice. They specifically noted the staff’s willingness to “go the extra mile” for quick and accurate service.

Many testimonials highlight how dedicated account managers help clarify complex self-directed IRA regulations. Clients report feeling informed and confident after working with the team to tailor portfolios to individual goals.

A client who switched from a competing firm described Advanta IRA as “a huge improvement” citing their speed and accuracy after seven years of service.

The company accepts multiple document formats including mail fax and scanned PDFs which clients find convenient for submitting paperwork.

Industry Ratings

Advanta IRA holds several industry credentials that validate their service quality:

- BBB Accreditation: A+ rating maintained since 2014

- Focus on the User Rating: 3.5 out of 5 stars

- Google Reviews: Over 160 reviews with 4.6+ star average

- Assets Under Management: Over $25 billion in client assets

The company’s fee structure ranks competitively within the industry. Their transparent pricing model focuses on administrative costs without hidden charges or commissions which sets them apart from many IRA providers.

Employee feedback indicates positive work culture with good work-life balance and competitive pay though some note concerns about favoritism affecting job security.

Common Complaints

While Advanta IRA receives mostly positive feedback several recurring issues appear in customer reviews. Transaction processing delays frustrate some clients particularly during busy periods when response times slow down.

Communication challenges between brokers and the company have led to at least one BBB complaint about administrative delays though Advanta IRA contested these claims citing adherence to security policies.

Paperwork issues occasionally cause investment delays with some clients reporting frustration when documents require resubmission. A few critical reviews mention favoritism within the company affecting service quality for certain clients.

Customer support responsiveness varies with some clients experiencing longer wait times for answers to questions or transaction updates.

These service inconsistencies suggest room for improvement in operational efficiency even though the company’s overall positive reputation.

Pros and Cons of Advanta IRA

We’ve analyzed Advanta IRA’s strengths and weaknesses through extensive research to help you understand what sets this self-directed IRA provider apart from traditional custodians.

Our findings reveal distinct advantages for alternative investors alongside some limitations you should consider.

Pros

- Wide Alternative Investment Range: You can invest in real estate, private equity, precious metals, cryptocurrencies, and private lending through one platform.

- Dedicated Account Managers: Each client receives personalized guidance from knowledgeable professionals who understand alternative investments.

- Transparent Fee Structure: All costs are stated upfront with no hidden charges or surprise commissions.

- Fast Transaction Processing: Real estate deals and alternative asset transactions move efficiently with proper IRS compliance.

- Strong Educational Resources: Free weekly seminars and webinars help you understand IRS regulations without paying for expensive courses.

- Streamlined Administration: Network of specialized administrators provides expertise across different investment areas.

Cons

- Limited Brand Presence: Fewer customer reviews available compared to major competitors even though 20+ years in business.

- Smaller Scale Operations: Managing $2.3-2.5 billion versus trillions at large brokerage firms means potentially fewer resources.

- Investment Restrictions: Fixed annuities, variable annuities, certain insurance products, publicly traded stocks, and mutual funds aren’t supported.

- Processing Delays Reported: Some clients experience slower transaction times and communication gaps during busy periods.

Comparison with Alternatives

When we researched self-directed IRA providers, we discovered that the industry splits into two distinct camps: traditional custodians who limit you to stocks and bonds, and those who open doors to alternative investments. Our analysis reveals how each provider stacks up against the others.

Competitive Analysis

We examined the fee structures across major self-directed IRA providers and found significant variations. While some custodians charge flat annual fees regardless of account size, others carry out tiered pricing based on asset values.

The pricing ranges from $195 annually for accounts under $15,000 to $1,850 for accounts exceeding $750,000. This tiered structure becomes expensive for larger portfolios compared to providers offering capped fees at $500 annually.

| Fee Comparison | Account Value | Annual Cost |

|---|---|---|

| Tier 1 | Under $15,000 | $195 |

| Tier 2 | $15,000-$75,000 | $395-$595 |

| Tier 3 | $75,000-$750,000 | $795-$1,450 |

| Tier 4 | Over $750,000 | $1,850 |

Customer satisfaction ratings show over 160 Google reviews averaging 4.6 stars or higher. This positions the provider above average in customer experience metrics within the self-directed IRA space.

Unique Selling Points

Checkbook control stands out as the primary differentiator in our research. You write checks directly from your IRA account without waiting for custodian approval on each transaction. This feature eliminates the 3-5 day processing delays common with other providers.

The investment options extend beyond typical offerings. You can invest in private equity deals, issue loans from your IRA, and purchase cryptocurrencies. Most competitors restrict these asset classes entirely.

The educational program includes free weekly seminars that other companies charge $200-500 to attend. These sessions cover IRS compliance rules and investment strategies specific to self-directed accounts.

The dedicated account manager model ensures you work with the same person throughout your relationship. This contrasts with call-center models where you speak with different representatives each time.

Market Position

The self-directed IRA market serves two groups: passive investors seeking basic alternative assets like real estate, and active investors pursuing complex strategies. Our research places this provider firmly in the active investor segment.

The $3.5 billion in assets under administration represents a mid-sized position in the industry. Larger competitors manage $10-20 billion while smaller firms handle under $1 billion. This scale allows personalized service while maintaining operational stability.

The 22-year operating history since 2003 establishes credibility in an industry where new providers frequently enter and exit. The BBB accreditation and A+ rating reinforce market standing.

The focus on alternative investments like loans and private equity creates a specialized niche rather than competing directly with mass-market providers.

Final Verdict

Advanta IRA stands out as a reliable choice for investors seeking control over their retirement portfolios through alternative investments.

Their 22-year track record and transparent fee structure make them particularly appealing for those who want to diversify beyond traditional stocks and bonds.

We’ve found their dedicated account manager approach sets them apart from larger competitors who rely on impersonal call centers.

This personalized service combined with comprehensive educational resources helps investors navigate the complex world of self-directed IRAs confidently.

While they’re not the largest player in the industry and some users report occasional processing delays during peak periods we believe these drawbacks are outweighed by their strengths. The checkbook control feature and wide investment flexibility offer serious advantages for active investors.

For those ready to take charge of their retirement planning and explore alternative investments Advanta IRA presents a solid option worth considering.

Their commitment to transparency and client education makes them especially suitable for both beginners and experienced self-directed IRA investors.