Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

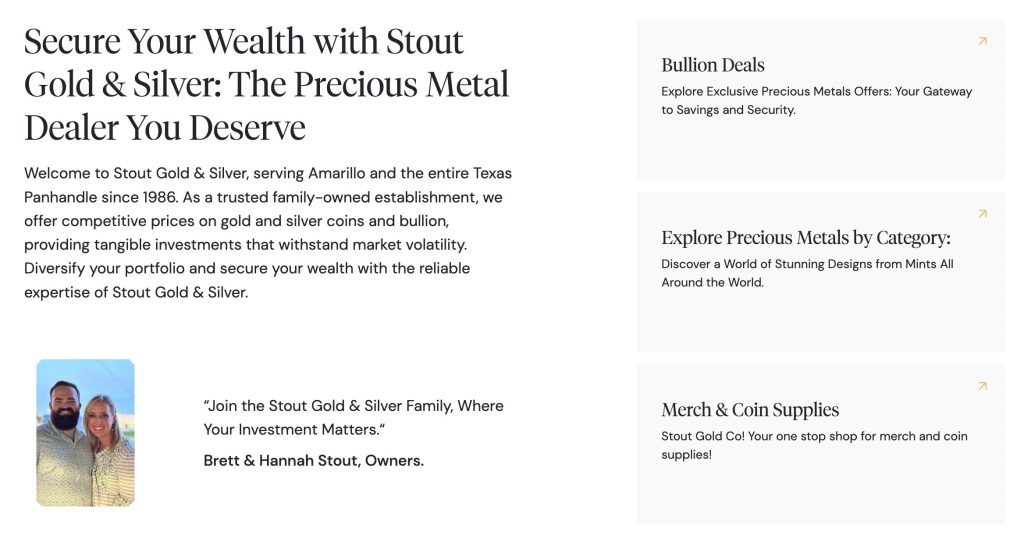

You’re searching for a precious metals dealer you can actually trust with your retirement savings. With over 30 years in business and virtually no complaints on record, Stout Gold & Silver has built something rare in this industry—a spotless reputation.

This family-owned Texas dealer specializes in buying and selling gold, silver, and other precious metals. You’ll find transparent pricing, personalized service, and a straightforward buyback policy that makes selling your metals simple.

Their commitment to customer education means you’ll understand exactly what you’re buying and why it fits your investment goals.

Table of Contents

- 1 Stout Gold and Silver: An Overview

- 2 Exploring Stout Gold and Silver’s Diverse Product Selection

- 3 Pricing Transparency and Value Analysis

- 4 Customer Engagement and Educational Resources

- 5 Secure Storage Options for Precious Metals

- 6 Reputation and Trustworthiness: Is Stout Gold and Silver Legit?

- 7 Tips for Choosing a Reputable Precious Metals Dealer

- 8 Conclusion

Stout Gold and Silver: An Overview

You walk into Stout Gold & Silver’s Amarillo office and immediately notice the difference. Since 1986, this Texas-based dealer has operated as a true family business—no corporate scripts, no pressure tactics. You’re dealing with people who’ve built their reputation one handshake at a time.

The company stocks gold and silver bullion coins, bars, rare collectibles, and even jewelry. You’ll find products from globally recognized mints like the U.S. Mint, Royal Canadian Mint, and Perth Mint. Each piece comes with authentication and meets investment-grade standards.

What sets them apart? Education comes first. Before you spend a dime, they’ll explain spot prices, premiums, and market trends.

You’ll understand exactly what you’re buying and why. Their pricing structure stays transparent—you see the breakdown of spot price plus premium on every transaction.

The numbers speak volumes. Over 35 years in business with virtually zero complaints filed with regulatory agencies. No lawsuits. No BBB disputes. In an industry plagued by fly-by-night operators, that track record matters.

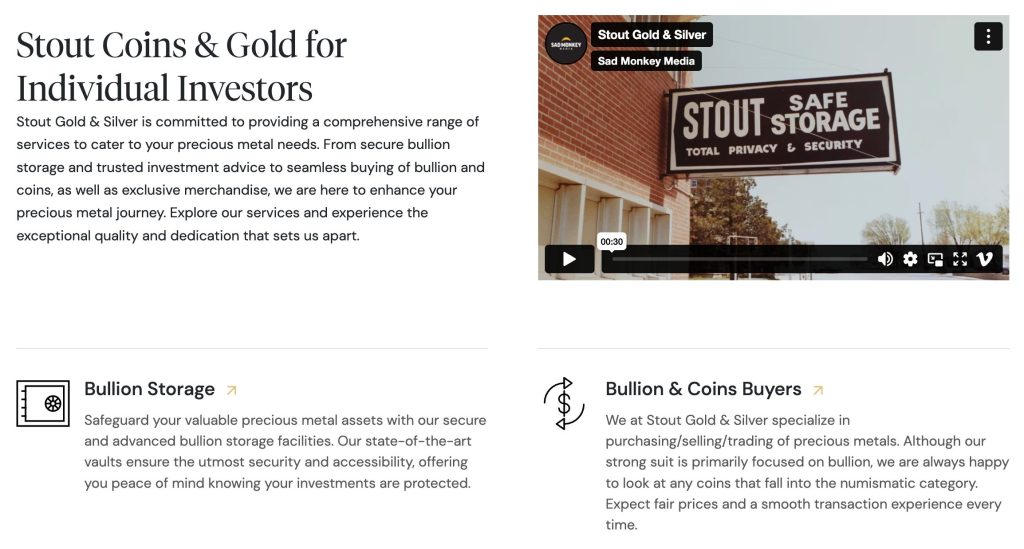

You can store purchases in their secure vaults or take physical possession. They’ll source specific coins or bars if you’re hunting something particular. When you’re ready to sell, their buyback policy guarantees fair market pricing without hidden fees.

Exploring Stout Gold and Silver’s Diverse Product Selection

Stout Gold and Silver’s product catalog spans investment-grade bullion to collector supplies, meeting diverse investor needs. You’ll find everything from gold coins to secure storage solutions in their carefully curated inventory.

Investment-Grade Bullion

You’re looking at gold coins from six continents when you browse their selection. American Gold Eagles, Canadian Maple Leafs, South African Krugerrands, Australian Kangaroos, and Mexican Libertads fill their displays. Gold bars come in 1-ounce, 10-ounce, and 1-kilogram sizes from established refiners.

Silver investors get equal variety. American Silver Eagles lead the lineup alongside Canadian Maple Leafs, Australian Kangaroos, and British Britannias. You’ll spot 10-ounce, 100-ounce, and 1,000-ounce silver bars for bulk purchases.

Platinum and palladium round out the precious metals offerings. These industrial metals provide portfolio diversification through their scarcity and manufacturing applications in automotive catalysts and electronics.

Rare and Collectible Numismatic Coins

History lives in their numismatic collection. Pre-1933 U.S. gold coins tell America’s monetary story through $20 Double Eagles and $10 Eagles. Colonial coins reveal early American commerce, while territorial pieces showcase the Gold Rush era.

World coins span centuries and continents. You’ll discover European sovereigns, Asian rarities, and South American treasures. Commemorative coins mark significant events—moon landings, presidential inaugurations, Olympic Games.

Each coin undergoes authentication and grading. Third-party certification from PCGS or NGC confirms authenticity and condition, protecting your investment value.

Gold and Silver Jewelry

Precious metal jewelry combines daily wear with investment value. Gold chains, silver bracelets, and platinum rings transform bullion into wearable assets. Each piece carries hallmarks confirming metal purity—14K, 18K, or 24K for gold; .925 for sterling silver.

Custom pieces turn family gold into modern heirlooms. You bring old jewelry; their craftsmen create contemporary designs while preserving the metal’s inherent worth.

Investment-grade jewelry maintains 90% or higher precious metal content. Unlike fashion jewelry, these pieces retain value through market fluctuations.

Exclusive Mint Releases

Limited mintages create immediate collector interest. Perth Mint’s Lunar Series releases 30,000 coins annually. Royal Canadian Mint’s Wildlife Series caps production at 1 million pieces. U.S. Mint proof sets sell out within hours of release.

First-day-of-issue coins command premium prices. You’re buying numbered certificates linking your coin to its initial mint date. Special packaging—wooden boxes, velvet cases—preserves these releases.

Early access notifications give regular customers purchasing advantages. Sign up for alerts about upcoming Austrian Philharmonic releases or Chinese Panda design changes.

Merchandise and Supplies

Coin albums organize collections by date and mint mark. Dansco albums display Morgan dollars chronologically. Whitman folders house Lincoln cents from 1909 forward. Each slot protects while showcasing your collection’s progress.

Air-Tite holders shield individual coins from fingerprints and atmospheric damage. Sizes range from dime-sized 17.9mm to silver dollar 40.6mm capsules. Square holders accommodate slabbed coins from grading services.

Display cases turn collections into conversation pieces. Glass-topped wooden cases hold 50 coins. Rotating displays showcase both sides simultaneously. Wall-mounted frames transform rare coins into gallery-worthy art.

Pricing Transparency and Value Analysis

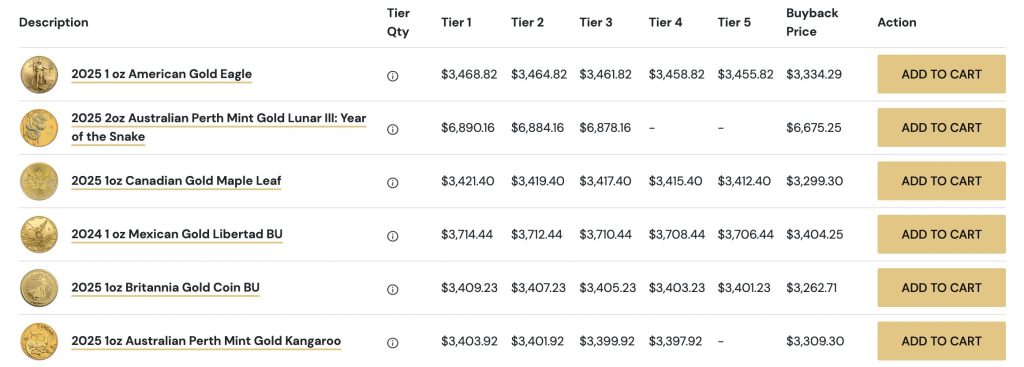

You check the price tag on a gold coin at Stout Gold & Silver’s website and see exactly what you’ll pay—no asterisks, no fine print, no surprise charges at checkout.

The 2024 Niue 1 oz Silver Spider-Man vs Green Goblin coin shows $36.82, and that’s precisely what leaves your bank account.

This transparent pricing approach sets Stout apart from dealers who bury fees in confusing terms. You’re looking at all-inclusive prices that factor in premiums, handling costs, and market rates.

When spot gold sits at $2,650 per ounce, you see the exact premium added to each American Gold Eagle or Canadian Maple Leaf.

The value equation extends beyond honest pricing. You’re getting authenticated products verified for purity—every gold bar stamped with its exact weight and fineness. Your silver coins arrive in original mint packaging, protecting both aesthetic appeal and resale value.

Customer reviews highlight rapid shipping (typically 3-5 business days) and professional packaging that prevents damage during transit.

First-time buyers appreciate the educational approach—staff explains spot prices, premiums, and market timing without pushing unnecessary purchases.

You’re paying competitive rates for tangible assets that hedge against inflation. Gold historically maintains purchasing power across decades, while silver offers both industrial demand and investment potential.

Customer Engagement and Educational Resources

You’ll discover that precious metals dealers rarely match the educational commitment found at this family-operated Texas dealer.

Their approach transforms confused newcomers into confident investors through personalized guidance and comprehensive market education.

Personalized Support and Guidance

You start your journey with experts who adjust their approach based on your experience level. Beginners receive patient explanations about spot prices and premiums while seasoned investors get advanced portfolio strategies.

Your consultation includes realistic goal-setting based on your budget and timeline. The team explains each product’s investment potential without pushing unnecessary purchases.

You’ll appreciate how they answer questions about storage options and tax implications. First-time buyers often mention feeling empowered rather than pressured during conversations.

Your personalized roadmap considers factors like risk tolerance and liquidity needs. They demonstrate product authenticity using testing equipment right in front of you. You leave understanding exactly why specific coins or bars match your objectives.

Education-First Approach

You gain access to comprehensive market analyses that decode price movements in plain English. Historical data presentations show you 50-year gold performance charts alongside major economic events.

Their economic insights connect Federal Reserve decisions to precious metals pricing. You receive explanations about supply-demand dynamics affecting silver’s industrial uses.

Market volatility becomes less intimidating when you understand its cyclical patterns. Educational materials cover topics from dollar devaluation to inflation hedging strategies.

You learn to spot the difference between numismatic premiums and bullion value. Their resources explain IRA eligibility rules for specific precious metals products.

Weekly market updates arrive in your inbox with actionable investment perspectives. You develop skills to evaluate deals independently using their pricing transparency tools.

Exploring the Buying and Selling Process

You begin purchasing by exploring product offerings through detailed online catalogs or in-person viewings. Consultation sessions clarify your investment goals before suggesting appropriate products.

Transaction processing includes transparent pricing breakdowns showing spot price plus premium calculations. Delivery options range from insured shipping to secure vault storage arrangements.

Selling starts with free appraisals using current market rates displayed on monitors. You receive immediate cash offers based on real-time precious metals pricing. Transaction completion happens within 24 hours after accepting their buyback offer.

Payment arrives via check or wire transfer according to your preference. Documentation includes detailed receipts showing exact weights and purity levels. You track shipments through provided insurance numbers ensuring peace of mind.

Positive Customer Feedback

You’ll read testimonials praising Brett’s patient explanations during complex numismatic purchases. Customers report receiving packages within 3-5 business days through insured carriers.

Fair pricing comparisons show their rates beating major online dealers by 2-3%. You’ll notice reviews highlighting staff members remembering client preferences across multiple transactions.

Professional packaging descriptions mention products arriving in protective cases with certificates. Quick response times average under 2 hours for email inquiries about product availability.

Testimonials emphasize zero-pressure environments where questions receive thorough answers. Repeat customers mention building collections over decades through consistent fair treatment. Reviews celebrate transparent buyback experiences matching quoted prices without hidden deductions.

Secure Storage Options for Precious Metals

You’re holding $50,000 worth of gold coins in your hands, and suddenly the weight isn’t just physical—it’s the responsibility of protecting your investment. Stout Gold & Silver transforms that anxiety into confidence with their 35-year-tested storage solutions.

On-Site Safety Depository

You gain access to a fortress-like facility where your metals rest behind multiple security layers. The state-of-the-art vault features 24/7 surveillance systems monitoring every angle.

Your assets receive segregated storage, meaning your specific coins and bars remain separate from other clients’ holdings.

Insurance coverage protects your full investment value against theft or damage. The facility maintains strict confidentiality protocols—only you and authorized personnel know about your holdings.

Professional Vault Services

You choose between allocated and unallocated storage based on your needs. Allocated storage assigns specific serial-numbered items to your account. Unallocated storage pools your investment with others while maintaining your ownership percentage.

Monthly statements detail your exact holdings and current market values. You access your metals within 48 hours of requesting withdrawal. Annual audits verify that every ounce remains accounted for.

Home Storage Alternatives

You install a TL-30 rated safe bolted to concrete for maximum home security. Fireproof models withstand 1,700°F for 120 minutes, protecting against house fires. Bank safe deposit boxes offer another layer of protection at $50-200 annually.

Reputation and Trustworthiness: Is Stout Gold and Silver Legit?

When you’re investing thousands in precious metals, legitimacy isn’t just important—it’s everything. Stout Gold and Silver has built a fortress of trust over three decades, backed by zero lawsuits and virtually no complaints.

Longevity and Community Trust

You’re dealing with a company that’s been part of Amarillo’s business world since 1986. The Stout family has served the Texas Panhandle for over 30 years, building relationships that span generations. Tom W. Stout established the business, and now his son Brett Stout continues the tradition.

Local investors return year after year because they’ve experienced consistent, reliable service. You’ll find customers who bought their first gold coins here in the ’90s now bringing their own children to learn about precious metals investing.

This multi-generational trust doesn’t happen by accident—it’s earned through decades of fair dealing and community involvement.

The company’s deep roots mean you’re not just another transaction. You’re joining a network of Texas investors who’ve trusted Stout through market crashes, boom times, and everything in between.

Minimal Complaints and Transparent Practices

You won’t find hidden fees or surprise charges at Stout Gold and Silver. The company maintains minimal complaints by posting all pricing clearly, including premiums over spot prices. Every fee for services like late payments or order cancellations appears upfront on their website.

Customer reviews consistently highlight the straightforward pricing structure. You see exactly what you’re paying for the metal’s spot price, the premium, and any applicable fees before completing your purchase. This transparency extends to their buyback policies, where current rates and procedures are clearly communicated.

The Better Business Bureau records reflect this commitment to clarity. Years of operation with minimal complaints demonstrate that when you know exactly what to expect, disputes rarely arise.

Open communication channels mean any concerns get addressed immediately, preventing misunderstandings from escalating.

Absence of Lawsuits

Search public records, and you won’t find legal proceedings against Stout Gold & Silver of Amarillo, Texas. This clean legal slate spanning over 30 years speaks volumes about their operational integrity. While other precious metals dealers face class-action suits or fraud allegations, Stout maintains a spotless record.

The absence of lawsuits isn’t luck—it’s the result of ethical business practices consistently applied. Every transaction follows clear protocols, every product meets stated specifications, and every customer interaction adheres to professional standards. You’re protected by their commitment to doing business the right way.

This legal clarity gives you confidence in your investment. You’re not risking your money with a company that cuts corners or makes promises it can’t keep. The lack of legal disputes confirms what customers already know: Stout delivers exactly what they promise.

Expertise in the Precious Metals Industry

Tom W. Stout brings decades of experience as Owner and President, while Brett Stout adds fresh perspective as Co-Owner.

This father-son team combines traditional knowledge with modern market understanding. You benefit from their combined expertise in both bullion markets and numismatic coins.

Their experience shows in the advice you receive. They’ll explain why certain coins command higher premiums, how market conditions affect pricing, and which products best match your investment goals. You’re not getting generic recommendations you’re receiving guidance shaped by years of watching market cycles.

Customers repeatedly mention the depth of knowledge available. Whether you’re asking about the difference between proof and bullion coins or seeking advice on portfolio allocation, you’ll get detailed, accurate answers. This expertise transforms your buying experience from a simple transaction into an educational opportunity.

Ethical Business Practices

You’ll never face high-pressure tactics at Stout Gold and Silver. The team focuses on education first, allowing you to make informed decisions at your own pace. They’ll explain options without pushing you toward the highest-margin products.

This approach creates a comfortable buying environment. You can ask questions, compare products, and even leave to think things over without facing aggressive follow-up calls.

The staff understands that precious metals investing requires careful consideration—they respect your decision-making process.

Customer testimonials consistently praise this no-pressure atmosphere. You’re treated as an intelligent investor capable of making your own choices, not as a sales target.

This ethical stance has created a loyal customer base that returns because they trust the advice they receive, not because they were pressured into purchases.

Tips for Choosing a Reputable Precious Metals Dealer

You’re standing at the crossroads of a major investment decision. The dealer you choose determines whether your precious metals journey becomes a success story or a cautionary tale.

1. Verify Dealer Credentials

Check the dealer’s registration with the Securities and Exchange Commission (SEC) first. You’ll find legitimate dealers maintain active licenses with financial regulatory bodies.

Look for accreditation from the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Corporation (NGC). These certifications prove the dealer meets industry standards for authenticity and grading.

2. Research Company Track Record

Dig into the dealer’s history before you commit. Years in business matter—established dealers like Stout Gold & Silver operate since 1986 without lawsuits or major complaints.

Check the Better Business Bureau rating and read customer reviews on Trustpilot. Pay attention to patterns in feedback about pricing transparency and shipping reliability.

3. Examine Pricing Structure

Transparent dealers show you exact breakdowns of spot prices and premiums. You’ll see all costs upfront without hidden fees buried in fine print.

Compare prices across multiple dealers for identical products. A 2024 American Gold Eagle might vary by $50-100 between dealers.

4. Evaluate Customer Support

Test the dealer’s responsiveness before purchasing. Call with questions about market trends or specific products.

Quality dealers educate without pressuring sales. Staff members explain concepts clearly and help you understand investment implications.

Conclusion

Making the right choice in precious metals dealers can significantly impact your investment journey. Stout Gold & Silver’s combination of transparency and expertise makes them stand out in an industry where trust matters most.

Their educational approach ensures you’ll understand exactly what you’re buying and why it’s valuable for your portfolio.

Whether you’re looking to diversify with gold coins or explore silver’s industrial potential, you’ll find competitive pricing and genuine support without the high-pressure tactics common elsewhere.

The secure storage options and buyback guarantees provide peace of mind that your investment remains accessible when you need it.

Your precious metals journey deserves a partner who values integrity as much as profitability. With their spotless reputation and decades of satisfied customers, Stout Gold & Silver proves that old-fashioned values still create modern success stories in the precious metals market.