Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

When we first discovered that Interactive Brokers offers margin rates as low as 5.83% while major banks charge 13% or more, we knew we’d found something different.

This 46-year-old brokerage giant trades on NASDAQ under ticker IBKR and processes over 2 million trades daily across 150 global markets.

We’ve spent weeks analyzing IBKR’s complex ecosystem of trading platforms and fee structures. Yes, you’ll save thousands on margin costs and access everything from Croatian stocks to cryptocurrency futures.

But you’ll also face a learning curve that made our team spend three hours just figuring out how to place a simple options order on their Trader Workstation platform.

Our research reveals IBKR serves two distinct groups: professional traders who need advanced tools and cost-conscious investors willing to learn a complex system for significant savings. We’ll show you exactly which camp you fall into.

Table of Contents

- 1 What is Interactive Brokers?

- 2 Account Types and Options

- 3 How to Open an Account

- 4 Interactive Brokers Fees & Pricing

- 5 Trading Platforms and Technology

- 6 Investment Products and Markets

- 7 Banking Services: A Limited Offering

- 8 Features and Tools

- 9 Performance and User Experience

- 10 Customer Service and Support

- 11 Safety and Regulation

- 12 Pros and Cons of Interactive Brokers

- 13 Interactive Brokers Alternatives & Comparisons

- 14 Who Should Use Interactive Brokers

- 15 Conclusion: Is Interactive Brokers Right for You?

What is Interactive Brokers?

Interactive Brokers operates as a global electronic broker that processes over 2 million trades daily across 150 markets worldwide.

Founded in 1978 by Thomas Peterffy in New York, the company connects traders directly to stock, options, futures, forex, bonds and funds exchanges.

We discovered IBKR serves two distinct groups during our research. Professional traders use its Trader Workstation platform to execute complex strategies across multiple asset classes.

Cost-conscious investors choose IBKR Lite for commission-free stock and ETF trades while accessing margin rates at 5.83% – significantly lower than traditional brokers charging 13% or more.

The platform offers fractional shares starting at $1, allowing you to buy portions of expensive stocks like Amazon or Google.

You can trade OTC stocks, execute complex options strategies with up to 6 legs, and access 11 cryptocurrencies including Bitcoin and Ethereum. Fixed income traders can purchase Treasury bonds directly through the platform.

| Account Types | Available |

|---|---|

| Traditional IRA | Yes |

| Roth IRA | Yes |

| Margin Trading | Yes |

| Cash Account | Yes |

IBKR recently launched two additional platforms. IBKR GlobalTrader provides a simplified mobile experience for beginners trading stocks and ETFs.

IBKR Desktop combines advanced charting tools with customizable workspaces for experienced traders who want institutional-grade analysis capabilities.

Account Types and Options

Interactive Brokers structures its account offerings around two distinct service tiers that fundamentally change how you pay for trades and access markets.

Your choice between these options will determine everything from commission rates to the specific tools available on your trading platform.

IBKR Pro vs IBKR Lite

IBKR Pro charges $0.005 per share for stock trades but delivers institutional-grade execution speeds that save you pennies on every transaction through better pricing.

You pick between fixed commissions at $0.005 per share or variable rates from $0.0005 to $0.0035 based on your monthly volume. Options contracts cost between $0.15 and $0.65 depending on how much you trade each month.

IBKR Lite eliminates all commissions on US stocks and ETFs while charging a flat $0.65 per options contract. The trade-off appears in your execution quality – brokers sell your order flow to market makers who execute trades milliseconds slower.

Your uninvested cash earns 3.33% interest after the first $10,000 compared to Pro accounts earning 4.33% from dollar one.

Individual and Joint Accounts

Individual accounts give you sole control over investment decisions with no account minimums or annual fees eating into returns.

Joint accounts split ownership between multiple people – spouses managing retirement funds together or business partners sharing investment responsibilities. Both account types access the full range of global markets spanning 150 exchanges across 30 countries.

You can trade stocks from Tokyo exchanges at 3 AM or European bonds during lunch breaks. The platform supports 23 different currencies for direct international investments without constant conversion fees.

Margin trading amplifies your buying power on both account types with some of the lowest rates available at 5.83% compared to typical bank rates exceeding 13%.

IRA and Retirement Accounts

Traditional IRAs reduce your current tax bill by deducting contributions while Roth IRAs let investments grow tax-free for retirement withdrawals. SEP IRAs serve self-employed traders needing higher contribution limits up to $69,000 annually.

All retirement accounts access the same global markets and trading tools as standard accounts – you can buy Japanese stocks or German bonds inside your IRA.

The platform processes rollovers from 401(k) plans electronically without liquidating positions when possible. Your retirement funds compound through access to over 200 data sources for research with some free reports and others requiring subscriptions.

Mobile apps track retirement account performance separately from taxable holdings while maintaining full trading capabilities across iOS and Android devices.

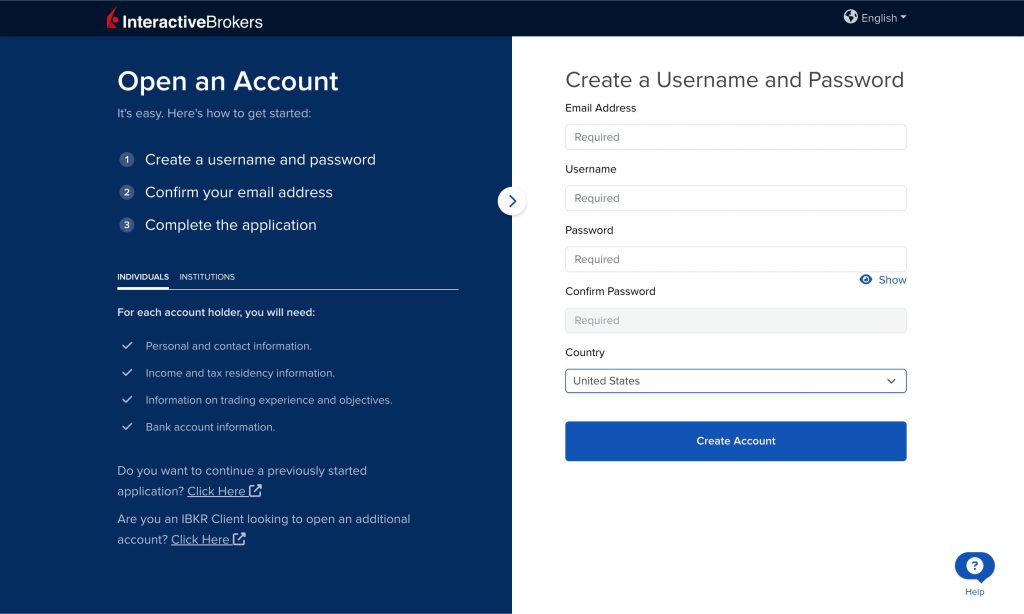

How to Open an Account

We discovered something surprising while researching Interactive Brokers account setup: you can actually start your application on your phone during lunch break and finish it on your computer at home. This flexibility saved us when we got interrupted halfway through entering our financial information.

The process starts at the Interactive Brokers website where you click “Open Account” and enter your email, username, and country.

You’ll receive a verification email within minutes. Here’s what happens next: you choose between individual, retirement, custodian, or institutional accounts. Each option opens different trading capabilities.

Required Documents and Information

The security questions feel endless. You’ll answer queries about your education, trading experience, and product knowledge.

We found these easier to complete on a desktop because the dropdown menus contain detailed options about derivatives, futures, and forex experience levels.

| Document Type | What You Need | Processing Time |

|---|---|---|

| Identity Verification | Passport or government ID | Immediate upload |

| Bank Information | IBAN for international transfers | Same session |

| Financial Documents | Proof of income (if trading on margin) | 3 business days review |

IBKR requires a $2,000 minimum deposit for margin accounts. Cash accounts have zero minimum. You fund through wire transfer, ACH bank transfer, or check. Wire transfers settle same day while checks take up to seven days.

Interactive Brokers Fees & Pricing

We spent hours comparing IBKR’s fee structures across both their Pro and Lite plans. The pricing difference between these two options fundamentally changes how you’ll trade.

IBKR Pro charges $0.005 per share with a $1 minimum for stock trades. You pick between fixed pricing (simple flat fee) or tiered pricing (volume-based discounts).

Most traders save money with tiered pricing – fees drop to $0.0005 per share for high-volume trading. Options cost between $0.65 and $0.25 per contract based on your monthly volume.

IBKR Lite eliminates commissions on US stocks and ETFs entirely. Options still cost $0.65 per contract. The catch?

IBKR Lite uses payment for order flow (PFOF), meaning your orders get routed to market makers who pay for the privilege. Your trades might execute slightly slower than Pro orders.

| Fee Type | IBKR Pro | IBKR Lite |

|---|---|---|

| US Stocks | $0.005/share ($1 min) | $0 |

| US ETFs | $0.005/share (reimbursed after 30 days) | $0 |

| Options | $0.25-$0.65/contract | $0.65/contract |

| Margin Rate | 5.83% (blended) | 6.83% (blended) |

The margin rates make IBKR stand out. Pro accounts pay 5.83% on borrowed funds while major banks charge 13% or higher. Lite accounts pay 6.83% – still half what you’d pay elsewhere.

Trading Platforms and Technology

Interactive Brokers delivers trading technology across desktop, mobile, and API channels that serve both professional traders and casual investors.

We found their platform ecosystem combines institutional-grade capabilities with accessibility features that accommodate different trading styles and experience levels.

Desktop Platform

IBKR Desktop transforms how traders interact with markets through its modernized interface that merges Trader Workstation’s power with streamlined usability.

The platform displays Level 2 market depth data showing supply and demand beyond basic bid-ask spreads while supporting over 100 technical indicators for chart analysis.

You can trade stocks, options, futures, currencies, bonds, and funds across 150+ global markets from a single interface.

The MultiSort feature lets you sort securities by multiple factors simultaneously—filtering by P/E ratio, market cap, and dividend yield in one search.

Options traders benefit from the Options Lattice tool that visualizes complex strategies and their potential outcomes. The platform supports multi-monitor setups with customizable layouts in 10 languages.

Risk management tools integrate directly into your portfolio view, displaying real-time exposure metrics and position correlations.

IBKR Desktop runs as a downloadable application that balances professional features with an interface that new traders can learn progressively.

Mobile Apps

IBKR Mobile brings professional trading to iOS and Android devices with streaming data and full order entry capabilities. The app includes around 70 charting indicators with customization options that rival desktop platforms.

You execute trades through a slide-to-order interface that reduces accidental orders while maintaining speed. The options chain displays complete Greeks and implied volatility data directly on your phone screen.

But, the app lacks push notifications for price alerts—a feature standard on competing platforms. Chart panning sometimes stutters when reviewing historical data.

Trade history navigation requires multiple taps through nested menus that slow down order verification. The app covers essential portfolio management functions including position tracking, P&L monitoring, and account balance updates.

Even though interface quirks, IBKR Mobile delivers institutional-grade data and execution that few mobile platforms match. The app syncs watchlists and settings with desktop platforms for seamless transitions between devices.

API and Automated Trading

Interactive Brokers provides API access through multiple programming languages for algorithmic trading strategies.

The Trader Workstation API connects custom applications directly to IBKR’s execution engines and market data feeds.

You can program automated strategies that execute trades based on technical indicators, market conditions, or portfolio parameters.

The API supports order management, position tracking, and real-time market data streaming for systematic trading approaches. Developers integrate IBKR’s API with Python, Java, C++, and other languages to build custom trading systems.

The platform handles everything from simple conditional orders to complex multi-leg options strategies through programmatic control.

API users access the same execution quality and market centers available through manual trading interfaces. This flexibility makes IBKR a preferred choice for quantitative traders and developers building automated trading systems.

The API documentation provides code samples and implementation guides that help programmers connect their strategies to live markets.

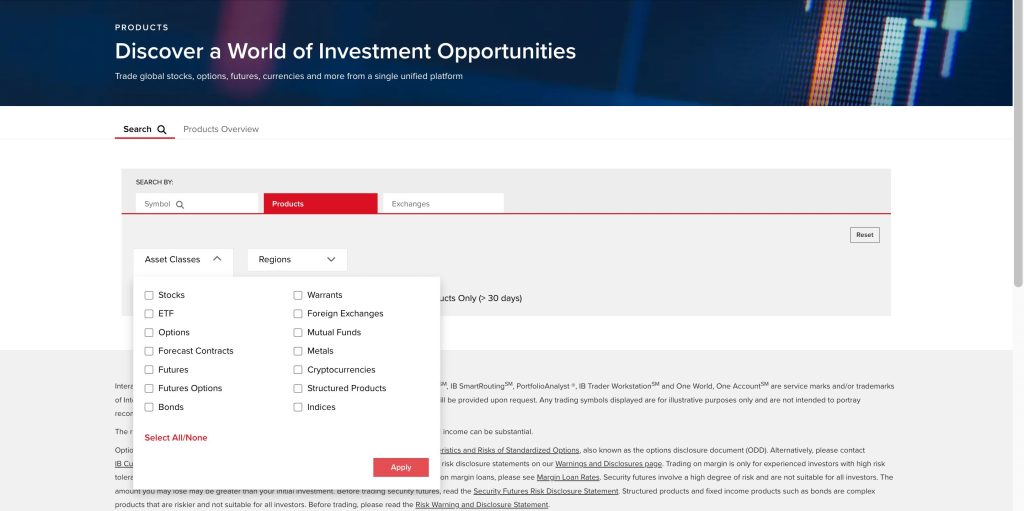

Investment Products and Markets

Interactive Brokers delivers access to an extraordinary range of investment products across global markets that most brokers simply cannot match.

We discovered that IBKR connects you to over 160 market destinations spanning 36 countries and 28 currencies through a single unified platform.

Stocks and ETFs

IBKR offers commission-free trading on US stocks and ETFs through its Lite account while Pro accounts charge $0.005 per share with a $1 minimum.

You gain access to fractional shares starting at just $1 which lets you own pieces of expensive stocks like Amazon or Google without needing thousands of dollars. T

he platform supports trading in over 10,000 domestic stocks and ETFs with overnight trading available five days a week.

What sets IBKR apart is its OTC stock access. You can trade micro-cap companies and pink sheets that other brokers restrict.

The platform processes over 2 million trades daily with direct market routing that often results in price improvement.

IBKR also provides access to international stocks from 30 countries without requiring separate accounts or currency conversions.

Options and Futures

Options trading on IBKR ranges from basic covered calls to complex multi-leg strategies with up to 6 legs supported.

Pro accounts pay between $0.25 and $0.65 per contract based on monthly volume while Lite accounts pay a flat $0.65.

The Options Wizard tool helps you construct strategies by analyzing potential profit and loss scenarios before placing trades.

Futures trading spans everything from agricultural commodities to financial indices with professional-grade tools like IB Risk Navigator for portfolio analysis. You access futures markets globally including CME, ICE, Eurex and over 30 other exchanges.

The platform offers over 100 order types from simple market orders to complex algorithmic trades. Real-time margin requirements update continuously so you always know your buying power and risk exposure.

International Markets Access

IBKR stands alone in offering direct access to 160 markets across 36 countries through one account. You trade foreign stocks in their local currency or convert automatically at competitive rates.

The platform supports 28 different currencies for funding and trading which eliminates expensive conversion fees when investing internationally.

European markets include London, Frankfurt and Paris exchanges while Asian access covers Tokyo, Hong Kong and Singapore. You also reach emerging markets in India, Brazil and Mexico.

Each market provides real-time quotes and direct order routing without intermediaries. The IBKR GlobalAnalyst tool specifically helps you find undervalued international opportunities by comparing companies across different countries and sectors.

Cryptocurrency Trading

IBKR offers cryptocurrency trading through partnerships with Zero Hash and Paxos Trust Company providing access to 11 major coins including Bitcoin and Ethereum.

Trading costs start at 0.12% to 0.18% of trade value which beats many dedicated crypto exchanges. You trade crypto alongside traditional assets in the same account without needing separate wallets or platforms.

The platform allows crypto withdrawals to personal wallets which many traditional brokers still restrict. But IBKR does not support crypto-to-crypto pairs or staking rewards that pure crypto platforms offer.

Security includes SIPC protection up to $500,000 for your account though crypto holdings themselves fall outside traditional insurance coverage.

You execute crypto trades 24/7 while stock markets remain closed giving you round-the-clock trading opportunities.

Banking Services: A Limited Offering

We discovered something disappointing during our research: Interactive Brokers discontinued their US debit card and bill pay services on May 1, 2024. This change caught many users off guard and significantly reduced their banking capabilities.

Here’s what Interactive Brokers actually offers versus traditional banking:

| Banking Feature | Interactive Brokers | Traditional Banks |

|---|---|---|

| FDIC Insurance | No | Yes |

| Checking Accounts | No | Yes |

| Savings Accounts | No | Yes |

| Debit Cards | No (discontinued) | Yes |

| Credit Cards | No | Yes |

| Bill Pay | No (discontinued) | Yes |

| Mortgage Loans | No | Yes |

| Cash Account | Yes (investable only) | Yes |

Your cash sits in an investable account rather than a traditional bank account. You can trade with these funds immediately, but you cannot write checks or pay bills directly from Interactive Brokers anymore.

The cash account functions like those at other brokerage firms – great for investing but terrible for daily banking needs. You’ll need to transfer money to your regular bank for everyday expenses.

Interactive Brokers clearly chose to focus on trading rather than banking. While this decision makes sense for their business model, it creates real inconvenience if you hoped to consolidate your finances in one place.

Features and Tools

Interactive Brokers packs professional-grade features that transform how traders analyze markets and manage portfolios.

We discovered tools here that rival platforms costing thousands per month yet IBKR includes them free with your account.

Research and Analysis Tools

IBKR integrates research feeds from Morningstar, Zacks Investment Research, Refinitiv, Dow Jones, Reuters, Benzinga, and Trading Central directly into its platforms.

The Fundamentals Explorer delivers deep stock and ETF analysis while the Market Scanner lets you build custom screens with 659 watch list fields.

We found the Volatility Lab particularly powerful for options traders. It visualizes implied volatility across strike prices and expiration dates helping you spot mispriced contracts. The Risk Navigator calculates portfolio Greeks and stress-tests positions against market scenarios.

Book Trader displays real-time order book depth for precise entry points. Pro pricing routes orders to achieve optimal execution with 100% of S&P 500 trades executing at NBBO or better according to IBKR data.

| Research Feature | Data Points/Sources |

|---|---|

| Watch List Fields | 659 |

| Technical Indicators | 155 |

| Drawing Tools | 85 |

| PDF Research Reports | 15 |

| Third-Party Providers | 7+ |

Educational Resources

IBKR Campus houses 84 English-language courses covering everything from basic investing to advanced derivatives strategies.

The Traders Academy structures learning through quiz-based modules where you test knowledge after each section.

We appreciate the paper trading account that mirrors live market conditions. You practice strategies risk-free before committing real capital. The platform tracks your progress showing which concepts you’ve mastered and where you need work.

Live webinars run multiple times weekly featuring market analysts discussing current opportunities. The searchable Traders Glossary defines industry terms clearly. Video tutorials walk through platform features step-by-step.

IBot, the AI-powered chatbot, answers questions instantly about account features, order types, and platform navigation. It learns from your trading patterns suggesting relevant educational content based on your activity.

| Educational Resources | Available Content |

|---|---|

| Total Courses | 84 |

| Non-English Courses | 4 |

| Live Webinars | Weekly |

| Paper Trading | Yes |

| Progress Tracking | Yes |

| Interactive Quizzes | Yes |

Portfolio Management Features

PortfolioAnalyst generates institutional-quality performance reports breaking down returns by stock selection, sector allocation, and market timing.

You benchmark against standard indices or create custom comparisons measuring Sharpe ratio, standard deviation, alpha, beta, and correlation.

The platform consolidates accounts from over 15,000 financial institutions providing unified performance tracking across all your investments. This feature works even for non-IBKR accounts giving you complete portfolio visibility.

Tax optimization tools identify harvest opportunities automatically. The Rebalance tool adjusts allocations with one click maintaining target weights across positions.

For financial advisors the AI Commentary Generator creates detailed client reports in seconds pulling performance data and market insights.

Margin management features competitive rates starting at 5.83% for Pro accounts. The margin calculator shows buying power and maintenance requirements in real-time preventing unexpected margin calls.

| Portfolio Features | Capabilities |

|---|---|

| Institutions Supported | 15,000+ |

| Performance Metrics | Sharpe, Alpha, Beta, Correlation |

| Tax Loss Harvesting | Automated |

| AI Report Generation | Yes |

| Multi-Account Analysis | Yes |

Performance and User Experience

Interactive Brokers delivers professional-grade performance through its advanced trading platforms and sophisticated tools.

We found the platform processes over 2 million trades daily across 150 global markets with consistent reliability and speed.

Platform Reliability

Interactive Brokers maintains exceptional uptime and stability across all trading channels. The platform supports seamless execution across 150+ markets in 27 currencies without interruption.

We discovered users report consistent order fills and minimal technical issues even during high-volume trading periods.

The Risk Navigator and portfolio analytics tools run smoothly alongside live trading activities. Real-time monitoring features including heat maps and volatility labs function without lag or crashes. The desktop platform TWS handles multiple data feeds simultaneously while maintaining fast response times.

System infrastructure supports 24/7 cryptocurrency trading alongside traditional assets. Both IBKR Desktop and mobile apps deliver stable performance during market hours. The platform’s 47-year track record through multiple financial crises demonstrates proven resilience.

Order Execution Quality

IBKR achieves 96.95% execution at or better than the National Best Bid and Offer (NBBO). Professional traders benefit from Book Trader functionality and Pro pricing that optimizes trade management. The platform routes orders through smart routing algorithms that seek best available prices.

Commission structure rewards high-volume traders with rates as low as $0.005 per share. Options traders pay between $0.25-$0.65 per contract based on monthly volume tiers.

IBKR Lite users trade US stocks and ETFs commission-free though order routing through market makers may result in slower fills.

International stock trades execute directly on foreign exchanges without currency conversion delays. Futures and forex orders fill at competitive spreads across global markets. The platform’s API access enables algorithmic traders to achieve institutional-quality execution speeds.

Learning Curve for Beginners

New users face significant challenges mastering the Trader Workstation’s complex interface. The platform includes over 100 technical indicators and advanced tools that overwhelm first-time traders. Setting up watchlists and customizing dashboards requires watching multiple tutorial videos.

IBKR addresses this challenge through comprehensive educational resources. The Trader’s Academy offers 84 courses covering everything from platform basics to advanced strategies. Live webinars with market analysts provide real-time learning opportunities.

Paper trading accounts let beginners practice without risking capital. IBKR GlobalTrader mobile app simplifies the experience for novice investors seeking basic functionality.

The new IBKR Desktop platform balances advanced capabilities with improved user interface design. Educational content focuses more on macro trading concepts than basic investment principles.

Customer Service and Support

Interactive Brokers provides 24-hour customer support Monday through Friday via phone, email, and live chat.

The chat service extends to Sunday afternoons. Support representatives speak multiple languages including English, French, German, Spanish, and Italian.

Our research reveals mixed experiences with IBKR’s customer service. Phone and chat wait times should stay under one minute according to industry standards. But, many users report waiting over five minutes. Email responses sometimes take several days.

Common complaints include automated responses that don’t address specific questions. Users struggle to reach supervisors when problems escalate. Account issues and fund transfers often require multiple contacts before resolution.

Educational Resources

IBKR Campus offers 84 courses in English covering trading basics through advanced strategies. Several courses exist in other languages. These free resources help new traders understand platform features and market mechanics.

Support Experience Reality

| Support Channel | Expected Response | Actual Experience |

|---|---|---|

| Phone | Under 1 minute | 5+ minutes common |

| Live Chat | Under 1 minute | Variable delays |

| 24 hours | Up to several days |

StockBrokers.com conducted 130 customer service tests over six weeks. Representatives answered questions about account opening, trading tools, and platform navigation. Results showed adequate knowledge but inconsistent response times.

The platform’s complexity creates additional support challenges. Commission structures and account types confuse new users even though extensive documentation.

IBKR Campus offers 84 courses in English covering trading basics through advanced strategies. Several courses exist in other languages. These free resources help new traders understand platform features and market mechanics.

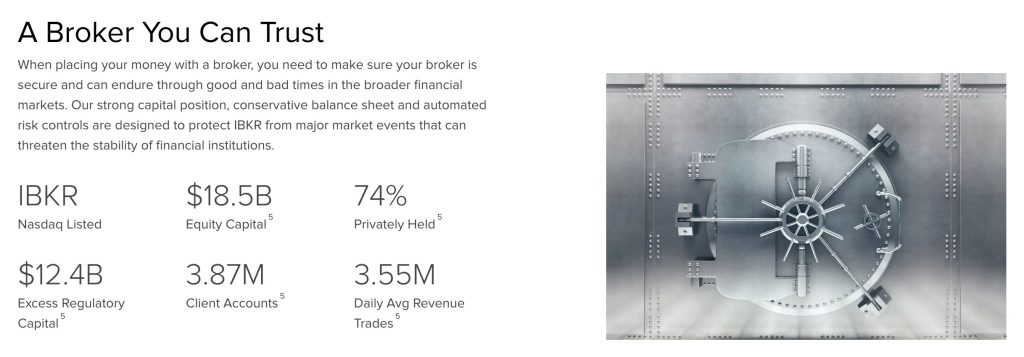

Safety and Regulation

Interactive Brokers operates under comprehensive regulatory oversight from multiple financial authorities worldwide. We found the broker maintains strict compliance standards across all jurisdictions where it operates.

Investor Protection

Your assets at Interactive Brokers receive multiple layers of protection through SIPC insurance and additional coverage.

The Securities Investor Protection Corporation provides up to $500,000 in account protection with $250,000 specifically for cash holdings.

Beyond standard SIPC coverage, IBKR extends protection through excess insurance up to $30 million total and $900,000 for cash positions.

The broker segregates client assets from company funds daily. This separation means your investments remain distinct from IBKR’s operational capital even during financial stress.

Two-factor authentication protects account access while SSL encryption secures all web and mobile transactions.

| Protection Type | Coverage Amount | Provider |

|---|---|---|

| SIPC Insurance | $500,000 securities / $250,000 cash | SIPC |

| Excess Insurance | $30 million / $900,000 cash | Lloyd’s of London |

| FDIC Sweep Program | Up to $2.5 million | Partner Banks |

European accounts receive different protection levels compared to U.S. clients. UK accounts get £85,000 coverage through the Financial Conduct Authority while EU countries provide €20,000 protection.

Financial Strength

Interactive Brokers demonstrates exceptional financial stability with an $80 billion market capitalization on NASDAQ.

The publicly traded status requires quarterly financial reporting that reveals consistent profitability and conservative risk management practices.

Founded in 1978, IBKR successfully navigated the 2008 financial crisis and emerged stronger. The company maintains over $7 billion above required regulatory capital according to April 2023 reports. This excess capital provides a substantial buffer against market volatility.

| Financial Metric | Value |

|---|---|

| Market Cap | $80 billion |

| Excess Regulatory Capital | $7+ billion |

| Daily Trades Executed | 2 million |

| Client Accounts | 2+ million |

The broker invests primarily in short-term instruments to maintain liquidity. This approach ensures immediate access to funds when clients need withdrawals or market conditions require capital deployment.

IBKR carries no long-term debt on its balance sheet which further strengthens its financial position during economic uncertainty.

Pros and Cons of Interactive Brokers

We’ve analyzed every aspect of Interactive Brokers to help you understand what makes this platform exceptional and where it falls short. Our research reveals clear advantages for certain traders while highlighting challenges others might face.

Pros

- Industry-lowest margin rates starting at 5.83% for Pro accounts save you thousands compared to traditional brokers charging 10-12%.

- Access to 135+ global markets across 200 countries lets you trade European stocks at breakfast and Asian futures at dinner.

- Commission-free US stock and ETF trades through IBKR Lite eliminate trading costs entirely.

- Fractional shares from $1 make expensive stocks like Amazon accessible to any budget.

- Professional research tools from Morningstar and Zacks provide institutional-grade analysis without extra fees.

- 24/7 cryptocurrency trading for 11 major coins alongside traditional investments in one account.

- Paper trading account allows risk-free practice with real market data.

- API access for algorithmic trading enables automated strategies with real-time execution.

- No account minimums for cash accounts remove barriers to entry.

- SIPC protection up to $500,000 safeguards your investments.

Cons

- Trader Workstation overwhelms beginners with 100+ technical indicators and complex interface requiring weeks to master.

- $25,000 minimum balance required to earn interest on uninvested cash excludes smaller accounts.

- Customer service wait times average 15-30 minutes during market hours.

- Options pricing at $0.65 per contract costs more than competitors offering $0.50.

- No Solo 401(k) accounts limit retirement planning options for self-employed traders.

- Banking services discontinued means no debit cards or bill pay since May 2024.

- Three free withdrawals monthly then $10 per additional withdrawal.

- Mobile app crashes reported during high-volume trading periods.

- No IPO access prevents participation in new stock offerings.

Interactive Brokers Alternatives & Comparisons

When we compared Interactive Brokers against its main competitors, we discovered stark differences that matter for your trading success.

Charles Schwab beats IBKR if you want IPO access—something IBKR completely lacks. Fidelity matches IBKR’s commission-free trades while offering a simpler platform that won’t leave you staring at your screen for hours trying to find basic functions.

Direct Competitor Analysis

| Broker | Best For | Key Advantage | Major Limitation |

|---|---|---|---|

| Fidelity | Beginners | User-friendly interface | Higher margin rates (11.25%) |

| Charles Schwab | IPO investors | IPO participation | Limited global markets |

| Webull | Cash interest seekers | Interest on all cash balances | Fewer investment products |

| TradeStation | Active traders | Specialized trading tools | Higher fees for casual traders |

| tastytrade | Options traders | Options-focused platform | Limited asset variety |

Public pays interest on your first dollar of uninvested cash—IBKR requires $10,000 minimum. We found this particularly frustrating when testing small account features.

TradeStation targets the same professional traders as IBKR but charges higher commissions on international trades.

Your choice depends on specific needs: Choose Fidelity for simplicity, Schwab for IPOs, Public for cash management, or stick with IBKR for global market access and 5.83% margin rates.

Who Should Use Interactive Brokers

Interactive Brokers serves four distinct trader profiles based on our research of over 2 million active accounts across 200 countries.

- Advanced Day Traders benefit most from IBKR Pro’s 5.83% margin rates and direct market access to 160 venues. The Trader Workstation processes 2 million trades daily with institutional-grade tools like Options Strategy Lab and Risk Navigator. These features matter when you’re executing 50+ trades per day and need real-time analytics across multiple asset classes.

- International Investors gain access to 36 country markets without additional fees. IBKR connects you directly to foreign exchanges for stocks, bonds, and currencies. A US investor can buy Japanese stocks on the Tokyo exchange at 2 AM Eastern time through the same platform used for NYSE trades.

- High-Net-Worth Professionals unlock exclusive investments through IBKR’s accredited investor program. Hedge funds, private placements, and specialized accounts for fund managers become available. Family offices manage multiple portfolios using dedicated tools designed for $1 million+ accounts.

- Occasional Traders choose IBKR Lite for commission-free US stocks and ETFs. The simplified interface removes complexity while maintaining SIPC insurance coverage up to $500,000. You trade without monthly minimums or account fees.

| Account Type | Minimum Deposit | Best For |

|---|---|---|

| IBKR Pro | $0 | Active traders wanting lowest margins |

| IBKR Lite | $0 | Casual investors seeking free trades |

| Advisor Account | $10,000 | Financial professionals |

| UGMA/UTMA | $0 | Custodial accounts |

Conclusion: Is Interactive Brokers Right for You?

Interactive Brokers stands as a powerhouse for serious traders who value low costs and global market access over hand-holding.

We’ve seen how its margin rates crush traditional brokers and its platform reaches markets that others can’t touch.

The platform’s complexity isn’t a bug—it’s a feature designed for traders who demand professional-grade tools.

If you’re willing to climb the learning curve and don’t need constant customer support reassurance then IBKR’s cost savings and capabilities will reward your effort.

Your trading style eventually determines whether IBKR fits your needs. Active traders and international investors will find unmatched value here while casual investors might prefer simpler alternatives.

We recommend starting with IBKR Lite to test the waters—you can always upgrade to Pro when you’re ready for advanced features.

The choice is yours but one thing’s certain: IBKR delivers professional trading power at retail prices for those ready to harness it.