Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

Last month, I spent hours comparing Goldco and Noble Gold Investments after my financial advisor mentioned precious metals. Both companies caught my attention, but for different reasons.

Goldco impressed me with their customer support, while Noble Gold’s lower minimums seemed more accessible. Read the full comparison below to see which company may better fit your goals.

Table of Contents

Quick Overview

- CEO: Trevor Gerszt

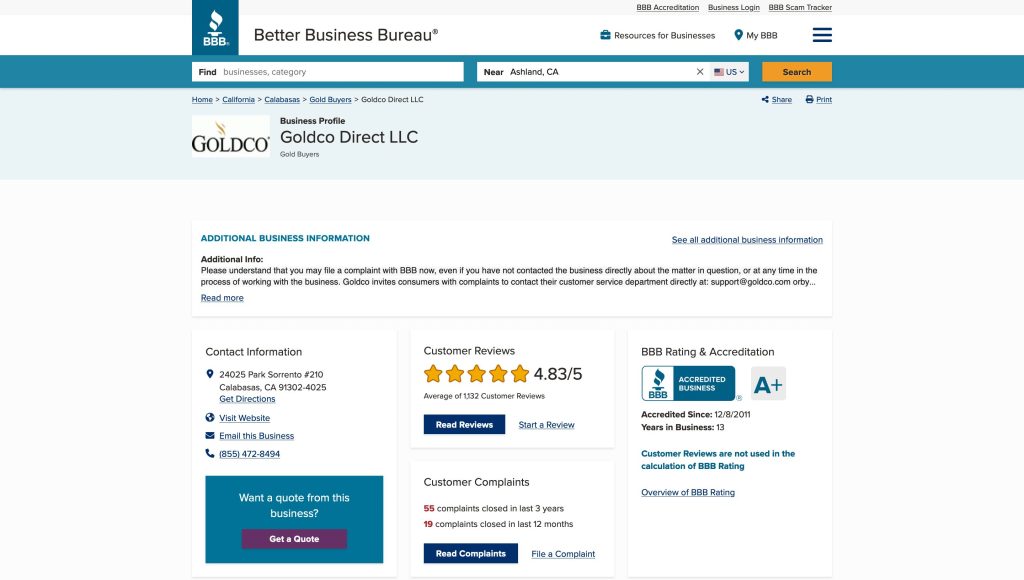

- BBB: 4.83/5 Out of 1,205 Customer Reviews

- Available Metals: Gold, Silver, Platinum, and Palladium

- Minimum: $25,000

- Promotions: Get Up to $10,000 in Free Silver on Qualified Purchases

- Free Kit Available: Yes

What is Goldco?

Founded more than a decade ago by Trevor Gerszt in Calabasas, California, Goldco has grown into a well-recognized name in the precious metals space.

The company focuses on gold and silver IRAs, offering alternatives to conventional retirement accounts for those seeking greater asset diversification.

Over time, Goldco has broadened its scope beyond IRAs, making a wider range of physical precious metals available to its customers.

A core part of the company’s mission centers on long-term wealth preservation, helping customers protect their savings by using gold and silver as a hedge against economic uncertainty.

The company’s dedication to protecting American retirement savings has earned prestigious recognition. These include an A+ rating from the Better Business Bureau and a Triple-A rating from the Business Consumer Alliance, demonstrating their commitment to excellence.

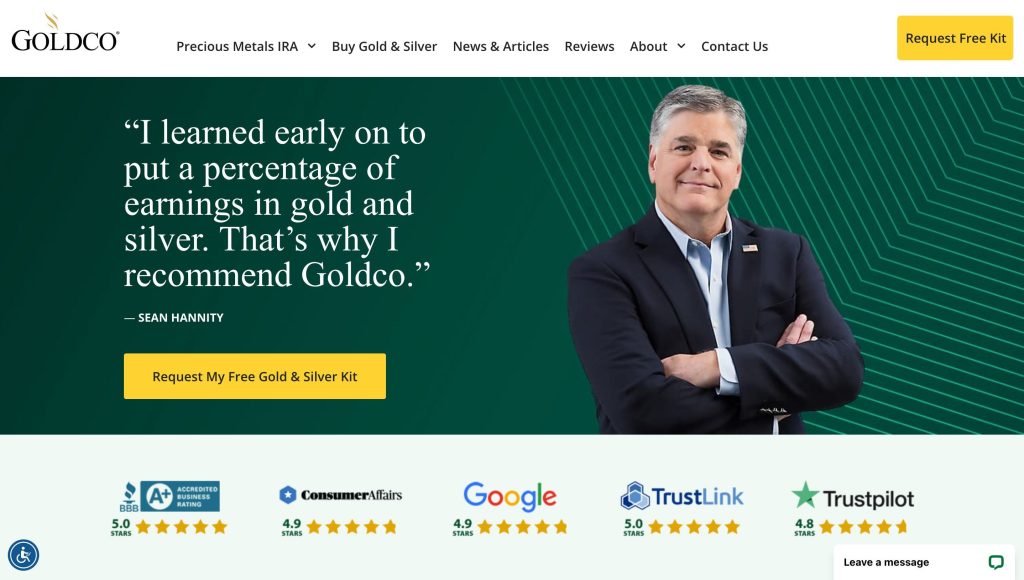

Goldco’s standing has been reinforced through endorsements from well-known figures such as Sean Hannity, along with Chuck Norris. These public endorsements have helped solidify the company’s credibility within the precious metals industry.

The company has also received recognition from major publications, including Inc. Magazine, which named Goldco among the fastest-growing private companies in the Pacific Region. This acknowledgment reflects the company’s expanding influence and operational strength within the industry.

Customer service excellence remains a cornerstone of Goldco’s operations. Their commitment to customer education and support is evident through thousands of five-star customer reviews across various platforms.

A consistent stream of positive customer feedback points to Goldco’s reliability in helping customers protect their long-term financial security through physical precious metals.

Steady service quality and high customer satisfaction have contributed to Goldco’s reputation as a dependable option for those seeking stability through gold and silver holdings.

What is Noble Gold Investments?

Noble Gold Investments is a precious metals firm with a depth of specialization that goes beyond what is typically found at general financial service companies.

Based in Pasadena, California, the company assists customers with buying and selling physical metals such as gold, silver, platinum, and palladium, offering hands-on support throughout the process.

Founded by Collin Plume, Noble Gold was built to make access to precious metals straightforward and approachable. The company offers multiple ways to use physical metals as a safeguard during periods of economic uncertainty.

A strong emphasis is placed on education and transparency, ensuring that both newcomers and experienced customers understand their options before making decisions.

Collin Plume’s background in finance and real estate adds a layer of practical insight, contributing to the firm’s reputation for dependable guidance and secure long-term planning.

To support informed decision-making, Noble Gold provides a wide range of educational materials and complimentary resources designed to clearly explain how precious metals fit into broader financial planning.

Noble Gold Investments has gained recognition for their commitment to:

- Building trust with customers.

- Providing educational resources.

- Protecting financial security.

- Maintaining transparent operations.

The company has received public support from well-known figures such as political commentator Charlie Kirk, reinforcing its credibility within the precious metals industry.

Operating from Pasadena also places the firm alongside a wide network of financial professionals, allowing customers to benefit from well-informed guidance and broader industry insight.

Customers appreciate Noble Gold Investments for:

- Easy metal buyback options.

- Clear communication.

- Customer-focused approach.

- Professional guidance.

Under Collin Plume’s leadership, the company has built a knowledgeable team known for attentive service and dependable support.

Their experience makes working with precious metals straightforward, offering multiple options designed to help protect long-term wealth.

Noble Gold Investments plays a meaningful role in wealth preservation, reflecting both a forward-thinking approach and a commitment to time-tested financial safeguards.

For those looking to shield their assets during periods of economic uncertainty, the company provides structured and reliable ways to hold precious metals with confidence.

Goldco and Noble Gold Investments Services

These well-known precious metals companies help Americans broaden their asset mix, particularly within retirement savings, by incorporating gold and silver.

This comparison looks at how each company supports its customers through dedicated precious metals retirement accounts, secure storage arrangements, and the range of products and services available.

Goldco

Goldco is known for strong customer satisfaction and dependable service, making it a popular choice for those looking to reinforce their retirement plans with precious metals.

Here’s a comprehensive look at their services:

1. Gold and Silver IRAs

Goldco specializes in establishing Gold and Silver Individual Retirement Accounts (IRAs). They streamline the process of transferring existing retirement funds into precious metals IRAs while maintaining IRS compliance.

Working alongside trusted industry partners, Goldco assists you in selecting appropriate IRS-approved precious metals and offers step-by-step guidance throughout the account setup process.

2. Bullion and Coins

Goldco provides a wide selection of bullion and coins for use within IRAs as well as for personal ownership.

Their inventory includes prestigious precious metal products like American Eagles and Canadian Maple Leafs, along with exclusive Goldco premium gold bars.

These options provide you flexibility for direct precious metals ownership beyond retirement accounts.

Types of Metals Available:

- Gold: Comprehensive selection including popular coins and bars such as American Gold Eagles and Gold Maple Leafs.

- Silver: Extensive range featuring American Silver Eagles and Canadian Silver Maple Leafs.

- Platinum and Palladium: Additional options for portfolio diversification.

Popular Products:

- American Gold Buffalo

- Gold American Eagle

- Gold American Eagle Proof

- Gold Maple Leaf

- Silver American Eagle

- Silver Maple Leaf

- Silver Great Barrier Reef | Stingray

- Silver First Moon Landing

Goldco follows IRS guidelines closely, offering approved precious metals for retirement accounts along with support for both IRA services and direct purchases of physical metals.

3. Gold and Silver Storage

Following IRS regulations, Goldco arranges secure storage through authorized facilities like Delaware Depository rather than offering home storage options for IRA.

These storage facilities offer full insurance coverage and high-level security while remaining fully compliant with regulatory requirements.

Goldco focuses on supporting precious metals retirement accounts through multiple IRA structures. The company also maintains a competitive buyback program, offers a wide range of educational materials, and works with trusted storage partners to help protect customer holdings.

Noble Gold Investments

Noble Gold Investments stands apart from traditional financial firms due to its specialized focus and deep experience in precious metals.

The company supports informed decision-making through clear education and practical guidance, offering options such as precious metals IRAs, physical bullion ownership, and secure storage solutions that help round out a broader financial plan.

1. Gold and Silver IRAs

Noble Gold Investments offers specialized retirement accounts that allow gold and silver to be held within an IRA, adding a tangible element to long-term retirement savings.

They help you set up this account, move your retirement savings into it, and choose the best gold and silver.

These IRAs can protect your savings from inflation and market ups and downs by including physical gold or silver.

2. Bullion and Coins

Precious metals can strengthen overall portfolio stability and security. Choosing products such as American Eagles, Canadian Maple Leafs, or Australian Kangaroos requires solid knowledge and careful timing.

These options convey many things such as physical ownership and also natural elements like wealth preservation which symbolize financial security.

3. Gold and Silver Storage

Secure storage plays a critical role in protecting physical precious metals. Noble Gold works with well-regarded facilities such as Brinks Depository and Delaware Depository, both known for advanced security systems and controlled storage environments.

Customers also benefit from comprehensive insurance coverage and strict security protocols designed to safeguard stored assets.

Beyond storage, Noble Gold offers a broad range of precious metals–related services. A strong emphasis is placed on education, including clear guidance and market insight, helping customers make well-informed choices with confidence.

Industry observers often point to Noble Gold as an important presence in the precious metals space, citing its practical approach and commitment to long-term asset protection.

The company also provides flexible options for wealth preservation, including IRA rollovers and physical metal ownership, allowing individuals to choose solutions that align with their financial priorities and personal preferences.

What Are the Differences Between Goldco and Noble Gold Investments?

Goldco and Noble Gold Investments are well-established names in the precious metals space, each offering different strengths for those looking to broaden their retirement holdings.

Recognizing the differences between these companies makes it easier to choose an option that aligns with long-term financial priorities.

These established gold IRA companies support gold IRA accounts and related services, though they vary in structure, pricing, and the range of choices available.

A side-by-side review highlights these distinctions and shows how each approach can influence long-term results.

Goldco

Goldco’s service framework includes clear fee structures, robust customer support, and a wide range of precious metals offerings.

Its standing across major review platforms, along with the specific products and services available, offers valuable insight for those evaluating whether Goldco is the right fit for their needs.

1. Fees and Pricing

The required minimum purchase at Goldco to start a gold IRA is $25,000. Goldco’s preferred Custodian charges a flat annual account service fee which includes a one-time IRA account set-up fee of $50. as well as a $30 wire fee. Annual maintenance is $100, and storage is $150 for segregated storage or $100 for non-segregated storage.

Fees for gold storage and custodianship can vary depending on the company you select to handle these services (required by the IRS, as all IRA assets must be managed by a custodian). Depending on the Custodian, storage fees can range from $10 to $60 per month, or as a percentage of assets, from 0.35% to 1% annually.

2. Customer Reviews and Reputation

| Platform: | Ratings: | Number of Reviews: |

| Trustpilot: | 4.8/5 stars | 1,607 reviews |

| Better Business Bureau (BBB): | 4.83/5 starts | 1,205 reviews |

| Google My Business: | 4.9/5 stars | 2,988 reviews |

| ConsumerAffairs: | 4.6/5 stars | 1,691 reviews |

| TrustLink: | 4.8/5 stars | 254 reviews |

Goldco has received mixed feedback from its customers regarding their services. Many customers praise the company’s ability to facilitate 401k transfers into precious metals IRA, highlighting the supportive and patient guidance provided throughout the process.

However, several customers report challenges with the company’s operations. These issues include delayed response times and unclear communication from sales representatives.

Additional complaints focus on unfulfilled promises regarding promotional silver offerings and delays in metal storage transfers.

A notable review describes an unpleasant interaction where a staff member displayed impatience, resulting in a negative customer experience.

Despite these concerns, the majority of customers express satisfaction with Goldco’s services, though a segment of customers remains dissatisfied with the company’s transaction handling and communication practices.

3. Available Choices

Goldco provides a full range of services for those looking to strengthen their retirement portfolios with precious metals.

The company focuses on gold and silver, offering options for personal ownership as well as through self-directed IRA accounts.

The company maintains a robust selection of IRS-compliant precious metals while providing expert guidance on gold IRA regulations and requirements.

This approach allows Goldco to support customers at all experience levels, from newcomers to those more familiar with precious metals.

Their offerings include American Eagle coins, Canadian Maple Leaf coins, and other government-minted products that meet IRS standards for precious metals IRAs.

Noble Gold Investments

Noble Gold Investments provides competitive pricing for gold and silver, with customers frequently praising the company’s professional approach and high-quality service.

The team is recognized for being supportive and attentive, offering clear guidance that makes navigating the world of precious metals straightforward and accessible.

1. Fees and Pricing

| Fee Type: | Amount: |

| Minimum Account for IRAs: | $20,000 |

| Minimum Purchase for Precious Metals: | $2,000 |

| Annual IRA Maintenance Fees: | $80 |

| Annual Storage Fees: | $150 |

| Gold IRA Setup Fees: | $0 |

| Shipping Fees for Metals: | $0 |

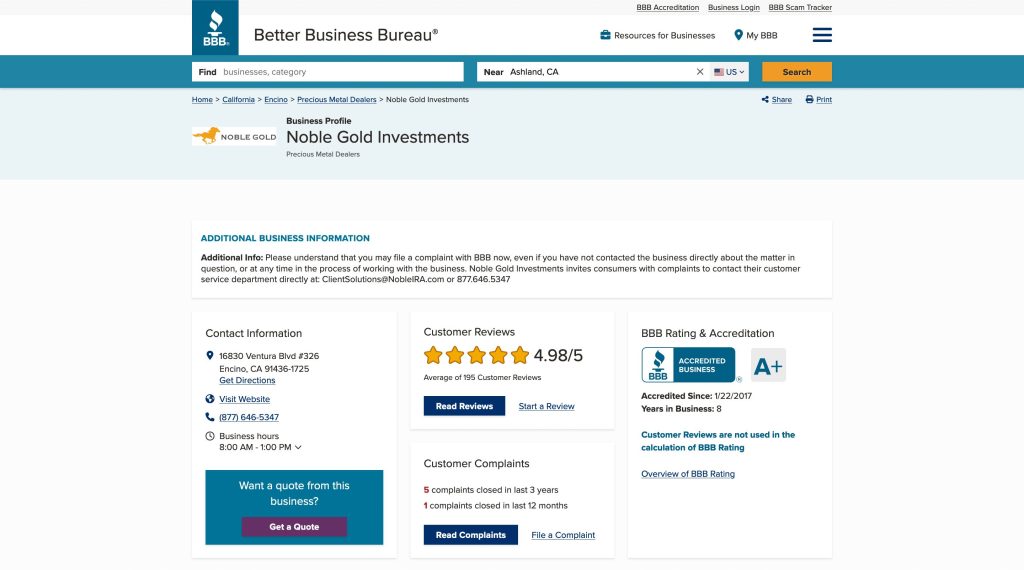

2. Customer Reviews and Reputation

| Review Platform: | Ratings: | Number of Reviews: |

| Truspilot: | 4.9/5 starts | 596 reviews |

| Better Business Bureau (BBB): | 4.97/5 starts | 207 reviews |

| Google My Business: | 4.9/5 stars | 599 reviews |

| ConsumerAffairs: | 5/5 stars | 812 reviews |

Noble Gold Investments generates mixed responses from customers. Some customers expressed disappointment due to immediate value depreciation after purchase and higher-than-market premiums on their precious metals acquisitions.

These customers report feeling misguided due to perceived communication gaps. However, many customers share positive experiences.

Satisfied customers emphasize the company’s educational approach, with agents dedicating time to schedule convenient consultation sessions and provide comprehensive guidance. They commend the representatives’ transparency and assistance throughout the transaction process.

Overall, while pricing concerns and communication clarity remain issues for some, others praise the company’s service quality and guidance.

3. Available choices

Noble Gold Investments specializes in facilitating precious metals additions to retirement portfolios, including gold, silver, platinum, and palladium.

Their primary offering includes precious metals IRAs, and specialized retirement accounts holding physical precious metals. These metals are selected for their historical stability and value retention properties.

Their expert team guides customers through metal selection processes, ensuring full IRS compliance. The company’s strategy focuses on preserving and growing retirement assets through secure precious metals.

They maintain strict adherence to regulatory requirements while helping customers diversify their retirement portfolios with tangible assets.

What Are the Similarities Between Goldco and Noble Gold Investments?

Goldco and Noble Gold Investments share key similarities that establish them as leading companies in the precious metals industry.

1. Focus on Precious Metals IRAs

Both companies excel in precious metals, demonstrating expertise in this specialized market segment.

Key similarities include:

- Core Business Focus: Goldco and Noble Gold Investments concentrate exclusively on precious metals, especially gold and silver. Unlike broad financial firms, they provide specialized knowledge and dedicated services focused on physical metals.

- Strategy: Both companies promote using precious metals to diversify retirement portfolios. They highlight gold and silver as a reliable way to preserve long-term value and provide a hedge against economic volatility.

Different Kinds of Metals

- Options: Both companies offer a comprehensive range of precious metals including gold, silver, platinum, and palladium. These metals are valued for their rarity and industrial applications, contributing to their stable market demand.

- Forms: Customers can select from a variety of physical options, including bullion coins and bars. Each choice is IRA-approved and suitable for both collectors and those seeking the tangible value of precious metals.

Helping with Money Plans

- Retirement Planning: Both companies offer specialized services for including precious metals in retirement accounts, allowing customers to retain traditional account benefits while holding physical gold and silver.

- Expert Guidance: Their dedicated focus enables comprehensive education and support for customers at every experience level, helping them understand how precious metals can strengthen and diversify their retirement planning.

These similarities reflect their commitment to:

- Providing secure options.

- Offering expert guidance in precious metals.

- Supporting long-term wealth preservation.

- Maintaining high industry standards.

- Delivering personalized customer service.

Both companies maintain strong reputations in the precious metals industry, backed by years of experience and positive customer feedback.

Their shared emphasis on education and customer support makes them trusted options for those looking to broaden their portfolios with precious metals.

2. IRA Custodianship Services and Metal Management

Goldco and Noble Gold Investments offer full IRA custodianship services, helping customers safeguard their retirement accounts with physical precious metals.

Managing Your Retirement Metals

- Professional Documentation Support: These companies focus on setting up precious metal IRAs, enabling customers to hold physical gold and silver instead of conventional retirement account assets. Their expert teams streamline the complex paperwork process, ensuring accurate setup and compliance with IRS regulations.

- Secure Storage Solutions: Federal regulations prohibit home storage of IRA-approved precious metals. Both companies partner with highly-rated depositories like Delaware Depository and Brink’s Global Services, offering state-of-the-art security systems and $1 billion insurance coverage for stored metals.

- Regulatory Compliance Management: The IRS maintains strict guidelines for precious metal IRAs, including specific purity requirements (99.9% for gold, 99.9% for silver). These companies ensure all transactions and holdings meet these standards, protecting your tax-advantaged status and preventing costly penalties.

Both companies maintain A+ ratings with the Better Business Bureau and provide 24/7 online account access.

Their storage facilities undergo regular third-party audits, and all metals are fully segregated and titled in the customer’s name for maximum security and transparency.

Which Company is Better?

Gold and silver IRAs through Goldco and Noble Gold provide distinct advantages that cater to different retirement planning needs. Both firms offer deeper expertise than traditional financial companies handling precious metals.

Goldco stands out for its strong customer support and educational resources, making it an excellent choice for those seeking guidance when adding precious metals to a retirement plan.

The company offers high-quality gold and silver products and simplifies IRA setup, providing clear options for long-term financial planning.

Noble Gold Investments shines in offering a variety of options, including standard IRAs as well as specialized selections like rare coins and collectibles.

With a secure storage facility in Texas, the company ensures high levels of protection, making it a reliable choice for those prioritizing asset security.

Each company brings its own strengths: Goldco emphasizes education and support, while Noble Gold focuses on variety and secure storage.

Together, they make it easier to include precious metals in retirement strategies and help customers achieve their financial goals with confidence.

Conclusion

When evaluating Goldco and Noble Gold Investments, customers should carefully consider their financial goals, fee structures, service quality, and available products.

Both companies maintain strong reputations in the precious metals industry, with proven track records of reliable service.

The best choice depends on each person’s financial goals and priorities. Careful research into the products and services offered by each company is essential before deciding.