Disclosure: “The owners of this website may be paid to recommend Goldco or other companies. The content on this website, including any positive reviews of Goldco and other reviews, may not be neutral or independent.” Learn More

Choosing a gold IRA can be a practical way to help safeguard retirement savings. Gold has long been viewed as a dependable store of value, especially during uncertain economic periods.

Getting started is much easier when the right details are laid out clearly. That’s where the five free gold IRA kits can be useful. Each one breaks down how gold IRAs work and what to expect, without unnecessary jargon.

For anyone considering adding physical gold to a retirement strategy, these free kits offer a clear, no-pressure way to learn the basics and plan ahead with confidence.

Table of Contents

1. Goldco

Goldco’s gold IRA kit provides a clear starting point for understanding precious metals. With its long history of excellence, which dates back to its establishment over a decade ago, the company has earned a reputation for its focus on customer education and satisfaction.

The company is widely respected for its clear guidance on gold and silver IRAs, including how to roll over funds from existing retirement accounts.

Goldco is known for putting a strong focus on education, clear business practices, and one-on-one support, helping customers feel confident about every step they take.

Goldco prides itself on endorsements from prominent figures, such as actor and martial artist Chuck Norris. Both have publicly supported Goldco, highlighting the company’s reliability and expertise in the precious metals market.

What Can You Get?

- A guide to Goldco’s services and their top-quality track record for over a decade.

- Easy steps to start your own gold or silver IRA.

- Why adding gold to your savings is a smart move.

- Help with moving money from your current retirement account.

- Looking at how the market moves and why gold stays valuable.

Who is the Best for?

- Those seeking an option that holds up during shifting economic conditions.

- Well suited for people looking to add something different alongside stocks and bonds.

- Well-suited for people worried about inflation, economic downturns, and market volatility affecting their retirement funds.

- Well-suited for those exploring tax-advantaged approaches to managing retirement savings.

Goldco has been doing this for a long time. With support from famous people, their free kit gives you all you need to know about making smart choices with gold and silver.

PROS:

- Comprehensive educational resources in multiple formats.

- Free shipping and handling.

- Tax and penalty-free strategies explained.

- Professional and experienced support from Goldco.

- Protection against economic volatility.

- Transparency with no hidden costs.

CONS:

- Depending on the performance of the precious metals market.

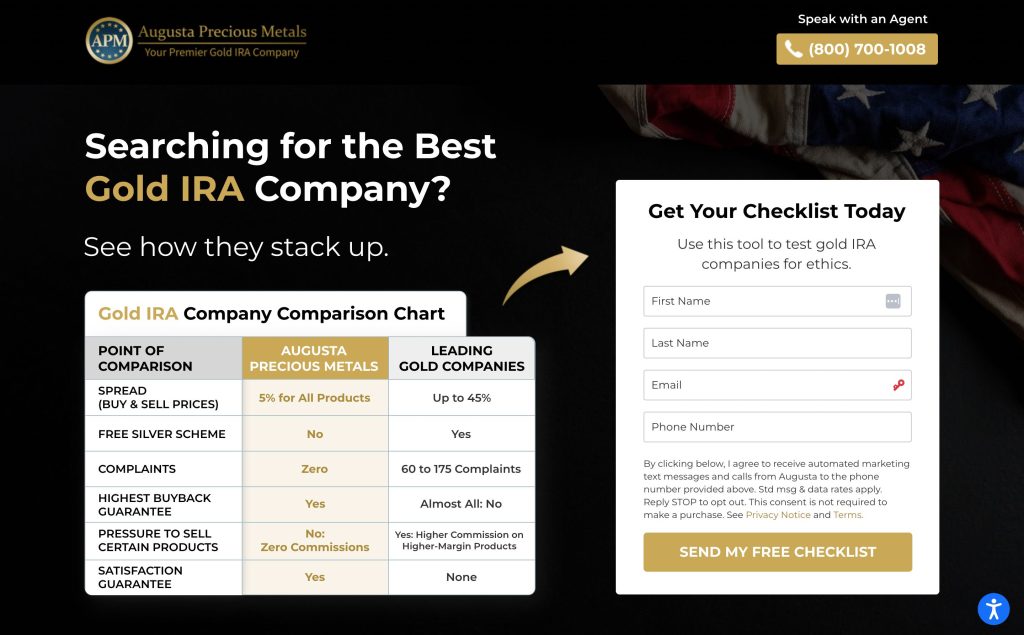

2. Augusta Precious Metals

Augusta Precious Metals focuses on teaching people how gold and silver can play a role in retirement planning. The company is based in Casper, Wyoming, and is known for its trustworthy service. They focus on making your retirement savings safer by including gold and silver.

Their guide makes learning about gold and silver IRAs easy. It answers common questions and walks you through a simple, three-step process. Famous football player Joe Montana, who uses and promotes Augusta, backs up the company’s good name.

What Can You Get?

- A complete walkthrough of setting up a gold IRA, including clear answers to common questions.

- A private online session with a trained economist to explore how precious metals can be used in long-term planning.

- Some accounts have no fees for up to 10 years, helping you save money.

Who is the Best for?

- Designed for people who plan to place a substantial portion of their assets into precious metals.

- People who want advice customized just for them from an economics expert.

- Those who want to save on fees in the long term with the special offer.

Augusta Precious Metals provides helpful education and support for those looking to safeguard and strengthen their retirement savings through precious metals, backed by knowledgeable guidance.

PORS:

- Transparent pricing and high-quality precious metals you can rely on.

- Support is always available, ready to answer any questions along the way.

- Information is provided in a way that’s easy to understand.

- Advice tailored to you, with the option to talk one-on-one with experts.

CONS:

- You need to join an online meeting to benefit from the guide's benefits.

- To bypass fees, a minimum of $50,000 is required, which could be too high for some people.

3. American Hartford Gold

American Hartford Gold gives out a free kit for people interested in adding gold and silver to their savings. This kit walks through the basics of getting started with precious metals.

Why it’s a good idea to have them in your money mix. And what special help can American Hartford Gold offer you?

They make things easy by offering to buy back your metals, sending them to you for free, and even giving up to three years of free storage for certain IRA changes.

This trusted company has many happy customers and top marks from the Better Business Bureau (BBB). It’s helped many people save their money in gold and silver, protecting it from big swings in the market.

Bill O’Reilly, known for his TV work and his political views, recommends American Hartford Gold. Having someone like him involved signals the company’s commitment to guiding people through gold and silver with real expertise.

What Can You Get?

- Easy-to-understand report on inflation.

- Simple explanations about gold’s value.

- Catalog of gold and silver you can add to your IRA.

- A detailed breakdown of gold’s long-term appeal and what makes American Hartford Gold stand out.

- Promise that your info stays private.

- Free service to move your IRA to gold, with no storage or insurance fees for three years.

- Guarantee that you can sell your gold back easily with no extra charge.

- A special offer that gives you free silver when you make a big purchase.

Who is the Best for?

- Individuals concerned about long-term inflation and dollar devaluation will find the kit’s in-depth analysis valuable.

- A detailed guide explaining gold’s long-term value and what sets American Hartford Gold apart.

- The kit offers useful insights for both newcomers and experienced buyers, helping clarify how gold works and how a gold IRA is structured.

It’s specifically made for those who want to keep their retirement money safe from the ups and downs of the economy and protect it from the decrease in purchasing power due to rising prices.

PROS:

- Shows how inflation can affect your money's value.

- Gives a big-picture view of the gold market.

- Provides a wide range of gold and silver options to grow your wealth.

- Highlights the benefits of gold and using American Hartford Gold for an IRA.

- Keeps your details safe and secret.

- Includes freebies like cost-free storage service for new gold IRAs and a gift of free silver.

CONS:

- The information is heavy on economics and might be hard for beginners.

- The company's website doesn't give much information about the company itself.

4. Birch Gold Group

Birch Gold Group, a top company in the United States for precious metals, offers a free kit. This kit teaches people how to protect their retirement money by using gold and silver. It helps them understand why adding these metals to a retirement plan can be a smart move.

Birch Gold Group focuses on educating customers about how gold and silver can help offset economic uncertainty, rising living costs, and shifts in the dollar’s strength, while explaining the risks of relying on a single asset.

Founded years ago, Birch Gold Group has built a strong reputation for being open, honest, and focused on educating its customers.

Famous people endorse this company, boosting its reputation. Ben Shapiro, Doug Casey, Steve Forbes, and Peter Schiff stand behind it. They share the view that precious metals like gold and silver play an important role in a well-balanced asset mix.

What Can You Get?

- Analysis of gold’s historical stability in times of economic downturns.

- Insights into the advantages of incorporating gold and silver into your IRA.

- Information on precious metals products for IRAs that meet IRS standards.

- Expert advice on safeguarding your savings against economic uncertainty.

- A guide to a lesser-known IRS provision benefiting IRAs or 401(k)s.

- Feedback from customers who have expanded their portfolios with Birch Gold Group.

Who is the Best for?

- Ideal for those looking to understand the more detailed advantages of holding gold within an IRA.

- Those looking to spread their assets to improve overall financial stability.

- People seeking fact-based insights on gold, its market role, and how it lowers economic risks.

- Those who value expert guidance and real-world success stories when making financial decisions.

- People who want to use IRS-sanctioned methods to protect their IRA or 401(k) with precious metals.

This audience will truly value what Birch Gold Group offers, aiding them to make smart, informed choices toward a financially secure future supported by gold’s everlasting worth.

PROS:

- Shows how gold can help protect and stabilize your portfolio.

- Offers factual guidance on diversifying with different types of assets.

- Provides tips to help avoid common pitfalls with gold IRAs.

- Gives professional tips and knowledge from special interviews.

- Tells about happy customers and their positive experiences.

- Describes a careful plan for adding gold to retirement funds.

CONS:

- Uses a negative kind of way to talk about economic dangers.

- You need to give your phone number to get the free kit.

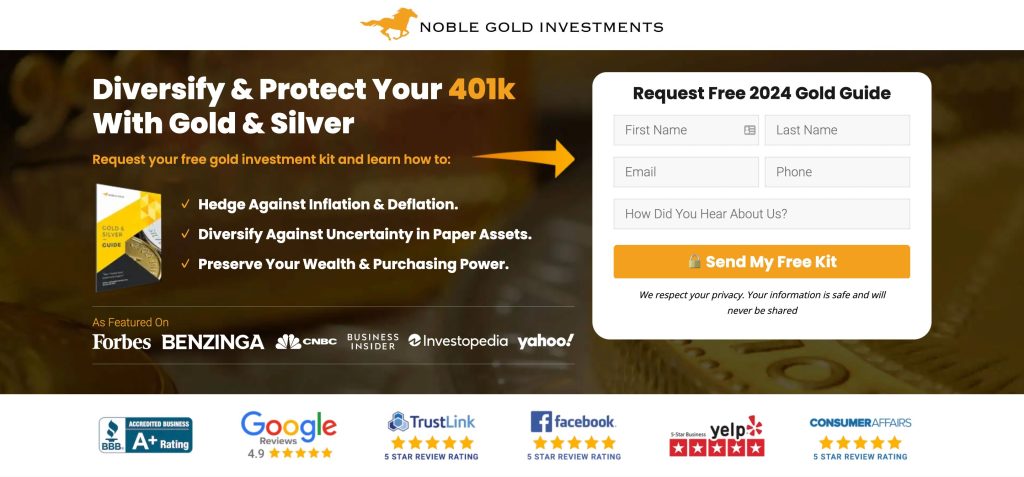

5. Noble Gold Investments

Noble Gold Investments offers a free kit to help people learn about gold and silver IRAs. This kit explains what a gold and silver IRA is and why adding gold and silver to your retirement plan is a good idea.

It explains how they keep your money safe from rising prices and tough economic times and shows you how to move your existing 401k into a gold or silver IRA.

Moreover, it lists the retirement accounts that work with a rollover and describes the different gold and silver items you can have in a gold IRA.

Charlie Kirk, a well-known political commentator, publicly supports Noble Gold Investments, a company focused on gold and silver services.

He supports Noble Gold Investments based on his belief in the long-term stability of precious metals during economic uncertainty.

What Can You Get?

- Guide on the tax benefits of precious metal IRAs.

- Steps for transferring a 401k to a gold IRA.

- Clear information on IRS-approved gold IRA rules and compliance requirements.

- Expert advice through personalized guidance from professionals.

- A range of precious metals, including gold, silver, platinum, and palladium coins.

- Secure storage options for precious metals at the Secure Texas Depository.

- Access to educational resources that explain precious metals in a clear, practical way.

Who is the Best for?

- Those seeking to broaden their retirement holdings with precious metals as a buffer against stock market swings.

- Individuals curious about the tax advantages tied to gold and how precious metals can help manage tax exposure.

- Those who prioritize secure storage through reputable, approved depositories.

- Users who value educational resources to help guide informed financial decisions.

- Those focused on IRS rules and compliance for precious metals IRAs will find Noble Gold Investments’ kit especially clear and reliable.

Noble Gold Investments appeals to a wide range of people, especially those looking to balance their retirement savings with gold and silver as a way to handle market swings and explore potential tax advantages.

PROS:

- Focus on how to use gold's tax benefits effectively.

- Easy-to-understand guide for the 401k to IRA transfer procedure.

- Essential details on staying within IRS rules for gold IRAs.

CONS:

- Offers only a small amount of information on gold and related strategies.

- No extra materials or special offers compared to other companies.

Why is it a Good Idea to Learn from a Free Gold IRA Kit?

A gold IRA can help balance retirement savings and provide protection during periods of economic uncertainty. Before starting, learning from a gold IRA kit can be helpful. Here’s why:

- Learning Benefits: These gold IRA kits explain how the gold market works and how people can get started with gold, and how to spot scams. This knowledge helps you make good choices.

- Understanding Costs: The kits show all the fees related to gold IRAs, like setup and storage fees. This helps you manage your expenses and pick the best service.

- Risk Management: You’ll see how adding gold can help strengthen your overall holdings, particularly during economic downturns.

- Making Smart Choices: With clear information about legal and tax rules for gold IRAs, you can plan better and make decisions that help your long-term retirement goals.

Things to Consider When Choosing a Gold IRA Kit

When searching for a free kit, choose one from a trustworthy gold IRA company. A trustworthy company provides clear, practical guidance you can rely on.

Their guide will teach you about gold IRAs, including their plus points, how to change your retirement money to a gold IRA, tax advantages, and what metals are okay.

Look for a company like Goldco, Augusta Precious Metals, American Hartford Gold, etc, that that are known for honest communication, strong support, and a genuine focus on customer outcomes.

A free kit from a reputable company helps you build knowledge upfront, without any cost. When a company focuses on education first, it’s usually a positive sign.

Take time to review customer feedback, ratings, company history, and the quality of their educational materials. This approach makes it easier to choose a free kit that aligns with your goals and helps you make informed decisions about precious metals.

Frequently Asked Questions

Q1. What is a free gold IRA kit?

A free gold IRA kit is a detailed information packet that explains the basics of gold IRAs and how they work.

It includes brochures, guides, market analyses, and sometimes a DVD, which help individuals understand how to use precious metals to secure their retirement savings.

Q2. Are gold IRA kits safe to receive?

Yes, gold IRA kits are safe to receive. They are usually sent by reputable precious metals firms that value customer security and privacy.

These kits are designed to inform, not to commit, you to any service. They ensure your personal details are protected throughout the inquiry process.

Q3. How do I get a free gold IRA kit?

To obtain a free gold IRA kit, you typically need to visit the website of a trusted precious metals firm and fill out a request form.

Most companies require basic information such as your name, address, and contact details to mail you the kit at no charge.

Q4. Are the gold IRA kits you mentioned above legitimate?

Yes, the gold IRA kits mentioned are legitimate. They are provided by established and reputable precious metals dealers known for their expertise and service in the industry.

These kits are educational resources created to help people make informed choices about gold IRAs.

Q5. Why Goldco’s gold IRA kit is the best?

Goldco’s gold IRA kit is highly regarded because it offers detailed, easily understood information on gold IRAs and includes personalized consultation options and customer reviews.

This sets it apart for its thorough educational approach, along with a strong emphasis on customer support and transparency.

Conclusion

In summary, the above free kits I’ve looked at are trustworthy and helpful for someone considering adding gold to their retirement plan.

They break down key details and explain gold IRAs in a way that’s easy to follow. For anyone thinking about long-term financial security, these kits offer a straightforward place to start without feeling overwhelmed.

PROS:

- Comprehensive educational resources in multiple formats.

- Free shipping and handling.

- Tax and penalty-free strategies explained.

- Professional and experienced support from Goldco.

- Protection against economic volatility.

- Transparency with no hidden costs.

CONS:

- Depending on the performance of the precious metals market.